Home / Markets / Commodities / As sugarcane crushing gathers steam in UP, focus shifts to crop's price

As sugarcane crushing gathers steam in UP, focus shifts to crop's price

UP is estimated to produce 45% of India's sugar in 2019-20 cycle

)

premium

4 min read Last Updated : Nov 15 2019 | 11:26 AM IST

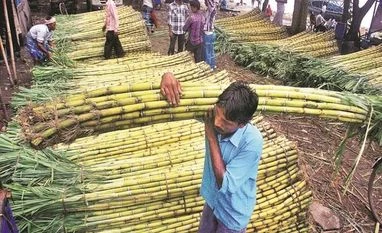

Sugarcane is gathering steam in Uttar Pradesh, raising the issue of how the government is going to fix the support price for the crop that supports almost 5 million farmers’ households in the state.

According to the Indian Sugar Mills Association (ISMA), UP is estimated to account for 12 million tonnes (MT) of sugar production in the current 2019-20 season, or more than 45% of the country’s estimated output of 26 MT.

Private millers had, through a series of letters written over the past few months to the state government, already harped on the subdued sugar market. This included muted exports and other factors, to fortify their argument against any prospective hike in UP sugarcane state advised price (SAP) for 2019-20. The state is likely to announce SAP in the next few days.

In its representations, the UP Sugar Mills Association (UPSMA), an affiliate of ISMA, apprised the government of the adverse scenario in the sector, which purportedly reduced their cash flow by Rs 30 per quintal (100 kg) ahead of the current season compared to the last season.

In its latest letter written to the chief minister last month, UPSMA president C B Patodia had demanded a subsidy/rebate of Rs 30 per quintal to bring the private mills’ cash flow at par with the 2018-19 crushing season.

The millers have also sought other sops, including Rs 12 per quintal as transport rebate on flat basis, payment of rejected/unsuitable cane variety at FRP, fixing cane society’s commission at Rs 2 per quintal, staggered payment to farmers with FRP paid upfront and difference between FRP and SAP to be paid at the end of sugar season, among other such demands.

While, the Centre has retained the cane fair and remunerative price (FRP) at Rs 275 per quintal sugarcane, for all the states, in 2019-20, UP traditionally announces a much higher SAP to remunerate the state farmers. Last year, the state had announced SAP of Rs 315 per quintal, which was Rs 40 per quintal higher than FRP. (See Table)

UP sugar table

| Crushing season |

Sugar output (Million Tonnes) | Value of sugarcane procured by mills | Fair and Remunerative Price (FRP) |

UP State Advised Price (SAP) (common variety) |

| 2011-12 | 7.00 | Rs 18,200 crore | Rs 145/quintal | Rs 240/quintal |

| 2012-13 | 7.40 | Rs 22,463 crore | Rs 170/quintal | Rs 280/quintal |

| 2013-14 | 6.47 | Rs 19,387 crore | Rs 210/quintal | Rs 280/quintal |

| 2014-15 | 7.10 | Rs 20,641 crore | Rs 220/quintal | Rs 280/quintal |

| 2015-16 | 6.85 | Rs 18,000 crore | Rs 230/quintal | Rs 280/quintal |

| 2016-17 | 8.75 | Rs 25,386 crore | Rs 230/quintal | Rs 305/quintal |

| 2017-18 | 12.05 | Rs 35,463 crore | Rs 255/quintal | Rs 315/quintal |

| 2018-19 | 11.82 | Rs 33,048 crore | Rs 275/quintal | Rs 315/quintal |

| 2019-20 | -- | -- | Rs 275/quintal | -- |

Earlier, the UP cane farmers’ representatives had demanded a much higher cane price, of almost Rs 500 per quintal, by citing the mills’ composite revenue streams comprising sugar, molasses, ethanol, cogeneration etc.

Meanwhile, about 35 UP sugar mills have started crushing operations, and by the month end, most of the 119 mills, including the private and government units, are expected to be functional.

“Currently, 30-35 mills have started crushing operations in the Western and Central UP regions. The plants in Eastern UP would soon join their league,” UPSMA secretary Deepak Guptara told Business Standard.

Currently, UP mills owe cane outstanding of about Rs 3,800 crore pertaining to the previous season. The millers attribute the buildup of arrears to the sugar market glut, export market squeeze, demand-supply mismatch leading to inventory stockpile etc.

According to ISMA, the domestic sugar production in 2019-20 season is expected to fall 20 per cent to 26 MT compared a more than 33 MT last year. The cane acreage is pegged at 4.83 million hectares (MH).

Several factors have resulted in lower sugar output, including heavy rainfall and flooding in key sugarcane growing areas of Maharashtra and Karnataka in September. This resulted in massive crop loss, apart from the growth in the domestic ethanol production capacity for mixing in petrol.

In Maharashtra, the floods affected Kolhapur, Sangli, Satara and Pune with prolonged inundation destroying crop. Thus, cane area for 2019-20 has dropped 33% to 776,000 hectares compared to last year’s acreage of 1.15 MH. Sugar production is pegged to drop 40% from more than 10 MT in 2018-19 to 6.2 MT this year.

In Karnataka, incessant heavy downpour in August affected North Karnataka areas in Belgaum and Bijapur districts. Therefore, cane area is expected at only 400,000 hectares against 500,000 hectares in 2018-19 with sugar output likely to hit 3.2 MT against 4.43 MT last year.