BSE to start bullion futures; metals, crude oil and natural gas to follow

NSE says it's also ready, commexes want more time

)

premium

.

Last Updated : Jan 04 2018 | 11:48 PM IST

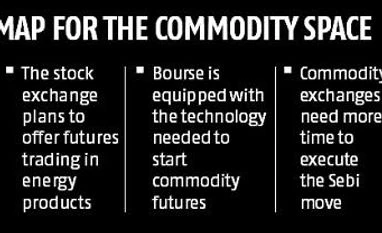

The BSE has become the first bourse to come out with a detailed plan on commodities derivatives after the Securities and Exchange Board of India (Sebi) last week approved a proposal allowing universal exchanges.

The BSE on Thursday announced free membership for the commodities segment and said trading would be launched in phases, beginning with bullion, followed by base metals, and subsequently crude oil and natural gas.

Sebi has approved universal exchanges and has said these can begin functioning from October. The move will intensify competition among the BSE, the National Stock Exchange (NSE), the Multi-Commodity Exchange, the National Commodity & Derivatives Exchange (NCDEX). The NSE has also said it is ready with its commodities plan but is yet to come out with details.

The NSE has also said they were ready as the technology required for the segment was in place. “We are ready technologically and also in terms of implementation to get into other asset classes. However, we will await further guidelines from Sebi in this regard," said Vikram Limaye, managing director and chief executive officer, NSE.

Sources said that the NSE would begin with bullion followed by precious metals like platinum and so on.

On Thursday, the BSE presented a roadmap for commodity futures to its members. "We were ready to launch commodity futures in 2015. We have upgraded our technology. BSE brokers will be able to trade in commodity futures on the same screen,” said A Chauhan, managing director of the BSE.

“We were waiting for this opportunity. We will start with non-agri commodities and expand the portfolio later. In fact, we have adopted the technology to start commodity futures but have waited for approval from the regulator. We took this technology to our exchange in Gift City and started commodity futures there," Chauhan added. The BSE's exchange in Gift City is generating around $300 million trading volume daily and currently has 15 per cent of the total open interest in gold.

All contracts that the BSE wants to offer are very liquid on the MCX and generate substantial volumes on its platform. “Since there will not be a fee for joining the commodities segment, existing brokers may apply for commodity trading membership separately, which the exchange commits to approve in one week. Apart from that, the BSE is keeping transaction charges at a minimum for commodity traders. Our margin cost is near zero, we can offer low transaction charges to our members," Chauhan said.

He pointed out options required a lot of market making and technology to deal with large orders, which the BSE had but the commodities exchanges did not.

Even as equity exchanges are eager to foray into other asset classes, commodity exchanges are seeking more time as they are in the process of improving their infrastructure and ramping up systems. “We had made a representation earlier to the market regulator, saying it was not a level playing field between commodities and equities. We will attempt to use the given timeline to bring ourselves on a par,” said Mrugank Paranjape, managing director and chief executive officer of MCX. He said the bourse had synergies with some asset classes, particularly currency.

“On convergence, we needed more time for rolling out institutional participation, new products, creation of clearing corporations and their recognition. We were able to achieve these tasks in three years. A lot of them have been achieved in the last two-and-a-half years,” Paranjape said.

The NCDEX, too, admitted that it needed more time. “We had requested Sebi to defer the timelines for allowing this. We needed more time to be ready and are in the process of setting up our clearing corporation. We see ourselves ready for convergence once this phase is completed,” said Samir Shah, managing director and chief executive officer of the NCDEX.