Coal India beats Street in Q3 with higher realisation and robust demand

Market remains cautious on volume growth and sustenance of e-auction premiums

)

premium

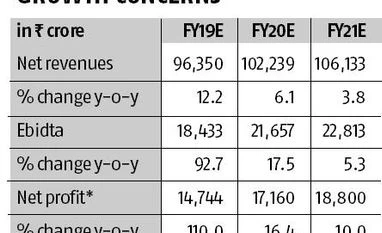

Coal India benefited from the robust demand during the December quarter (Q3). Strong demand, from both power and non-power sectors, pushed up realisations of coal sold under fuel supply agreement or FSA (where prices are pre-determined) as well as those through e-auctions (market determined pricing). However, overall volume growth remained tepid.

The mere single-digit year-on-year increase in volumes in Q3 also meant that after meeting obligations for supplies under the FSA, not much was left for e-auction sales. The sales mix suffered with 37 per cent year-on-year decline in e-auction sales, which are more profitable. With concerns over volumes and given the overhang on account of government’s stake sale plan continuing, it is not surprising that the Street’s reaction was muted even as Coal India posted better-than-expected Q3 numbers on Tuesday.

The mere single-digit year-on-year increase in volumes in Q3 also meant that after meeting obligations for supplies under the FSA, not much was left for e-auction sales. The sales mix suffered with 37 per cent year-on-year decline in e-auction sales, which are more profitable. With concerns over volumes and given the overhang on account of government’s stake sale plan continuing, it is not surprising that the Street’s reaction was muted even as Coal India posted better-than-expected Q3 numbers on Tuesday.