Equity MF exposure to non-bank lenders nears the Rs 1-trillion mark

IL&FS contagion worries: Funding woes cloud segment prospects

)

premium

graph

Last Updated : Sep 26 2018 | 8:06 AM IST

The equity exposure of mutual funds (MFs) to non-bank lenders approached nearly Rs 1 trillion, an analysis of data by MF tracker Value Research shows.

This includes housing finance companies, development finance institutions and those involved in equipment leasing, among others.

Mutual fund houses are likely to adopt a wait-and-watch approach, though some profit booking had started to set in before the crisis came to the fore, according to those watching the developments.

The ongoing fixed-income market issues affect some lenders more than others. Banks, which have a deposit base, have an easier time during a liquidity squeeze compared to those that have to raise large parts of their capital from the fixed income market.

Recent troubles related to Infrastructure Leasing & Financial Services Limited (IL&FS) resulted in a tightening of liquidity conditions in the fixed income market.

The company defaulted on its obligations and credit rating agencies downgraded the company, leading to fears of contagion. This resulted in a question mark on the financing of such companies. On Friday, a large number of non-banking financial companies (NBFCs) crashed in the stock market. Mutual funds had been stocking up on these shares in recent times, because of their increased prominence in providing credit for everything from home loans to corporate credit.

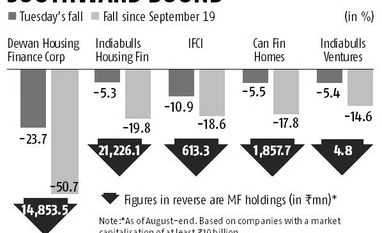

The worst-performing NBFCs (which have mutual funds as shareholders) from the S&P BSE 500 index fell between 14 and 51 per cent since then. Mutual funds had a collective exposure of over Rs 38.6 billion to just five companies, shows an analysis of Value Research data.

The fund manager of a large scheme said that the segment has been under pressure on account of the nature of their financing. They raised money through short-term paper, generally from fixed income mutual funds, and lent for the long-term.

This has been hit because of volatility in the fixed income market which may mean that future financing may also be affected, in turn, taking a toll on growth and profitability.

“There is fear (about how this will eventually pan out),” said the person.

Clarity is yet to emerge on how the liquidity situation will change, and fund managers are likely to avoid changing their stance on the NBFC space because of the recent volatility.

Kaustubh Belapurkar, director (fund research), Morningstar Investment Adviser India, said that the industry is unlikely to change its stance on NBFCs until concrete signs of fundamental issues emerge in the sector, over and above the reaction seen in the stock market.

“There is a fair bit of exposure but fund managers are likely to wait for the dust to settle before they take a call on the segment. There will not be a knee-jerk reaction just yet, though some fund managers are already cutting holdings because of the high valuations,” he said.

Interestingly, on an aggregate, fund managers had been increasing their bets as recently as August.

A mutual fund trading activity report from brokerage house Prabhudas Lilladher noted that mutual funds’ additional investments in the finance segment was over Rs 20 billion, making it the second-most bought sector for the month after banking.

“Banking and finance were among the most sought after sectors,” noted the September report authored by Jason Monteiro, assistant vice-president at Prabhudas Lilladher.