RIL, L&T, Infosys among IIFL's top-six investment picks for the long haul

Likening their performance and fundamentals to the pure technique of a test batsmen, IIFL Institutional Equities has ranked these six as its best choice for long-term investing

)

premium

IIFL

Last Updated : Jul 30 2018 | 4:11 PM IST

Indian benchmark equity indices,the BSE Sensex and the National Stock Exchange’s (NSE’s) Nifty50 have been hitting record highs of late.But growth has been limited to large-cap stocks; mid-caps have failed to join the party.

In the past few years, Indian stocks had been seeing a steep rise, on the back on mid-cap gains, with thevaluation of these stocks reaching significanthighs. According to an IIFL Institutional Equities report, these stocks’performance was akin to, in cricket terminology, Twenty20 – midcaps, indeed, were making records on Dalal Street.

However, things have changed since, and a deeper introspection exposes the top-heavy performance of stocks, with the ‘limited-overs’midcap specialists finding themselves in the role of, as they say in cricket, drinks-carrying 12th man.

According to the brokerage firm, the next one year or so will be a time for consolidation.Just like in Test cricket,you will need to choose players with strong fundamental techniques, balance sheet adaptability, earnings momentum to withstand the long sessions, and the leadership acumen to reap the benefits of endurance.

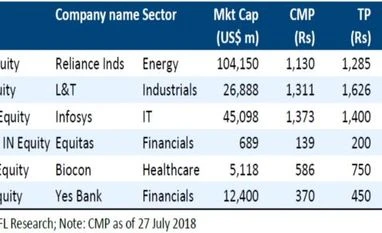

On the basis of its analysis, IIFL recommends six stocks that appear good for long-term investment. These are:

1. Reliance Industries

This oil refining giant struggled initially as it failed to channel its talents and squandered capex in exploration (and even retail). Finding itself being sidelined by investors for a large part of this decade, RIL suddenly found its mojo in the overcrowded telecom market (JIO) and now merits inclusion purely as a next-gen telecom all-rounder. Though outlook on RIL’s core refining and petrochemicals business is strong, execution surprise in JIO is likely to continue offering a much higher EV.

2. Larsen & Toubro

This stock can be good player in an early uptick of the investment cycle and be equally great in the more competitive late capex cycle. But conditions are key and we may need to wait for some signs of governmentspending to appear.However, there is no denying that L&T, with its strong a cash flow focus, has got fitter with divestment of the flabby non-core businesses.

3. Infosys

A return to a more conservative focus has helped Infosys carry very good form since the beginning of the year. With a focus on scaling the digital business and use of AI/Automation to modernise clients’ core, as well as accelerating large deals, its refreshing new look augers well. Also, with the rising dollar-rupee, this is one player that almost selects itself. Still trading at a 25% discount to arch rival TCS, this Indian IT behemoth will try to narrow the valuation discount down before the season ends.

4. Equitas Holdings

This company has been developing itself for the long run. It has focused exclusively on provisioning and clean-ups. Now, for the next three years, it will be all about operating leverage as the balance sheet grows. So returns on equity (RoE) will head to mid/high teens; and, Tier-I is at a whopping 27%. Still very cheap, it is a tailor-made player for the test game.

5. Biocon

Biocon may not be a purist in the truest sense, but it makes the X-Factor list. Biocon has established its credentials as a leading biosimilar player in global markets, with its partnership with Mylan. The addition of US/EU revenues from the first wave of biosimilars could potentially help Biocon’s profits grow by about six times over the next five years.

6. YES Bank

Recognising its true potential of becoming a pan-Indian legend, its strategic shift to retail assets and liabilities remains robust. Asset quality metrics now are more normalised and YES Bank seems to have a much better all-round defensive and attacking game, to deliver 1.7% return on assets and >20% RoE in the medium term. A capital-raising towards the end of the year could beef up its potential for a long innings.