A new challenge for the microfinance industry?

"Fresh start" is a welcome step as it will free up debtors from archaic laws but they need counselling to prevent misuse

)

premium

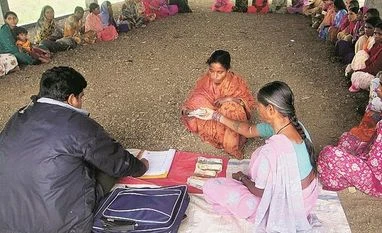

In October 2010, the enactment of a law in the southern state of Andhra Pradesh, then a hotbed of the microfinance industry, almost killed it. The law came into force in the wake of a spate of suicides by microfinance borrowers, allegedly harassed by the coercive measures adopted by the collectors of such loans.

The Reserve Bank of India (RBI) stepped in with regulations capping the interest rates, quantum of loans and the number of borrowers a microfinance company can entertain, and formation of credit bureaus, among other things. These brought the industry back from the brink of a collapse. The fact that eight of the 10 small finance banks were microfinance institutions (MFIs) testifies to the resurrection of the industry.

The next blow was demonetisation. In the 50 days between November 10 and December 30, 2016, Rs 15.4 trillion worth of currency notes of denominations of Rs 1,000 and Rs 500 — some 86.9 per cent of the value of the total number of notes in circulation then -- were withdrawn. That hit the microfinance industry hard as till that time most transactions of small loans were in cash. Their loan growth slowed and bad assets zoomed. The MFIs, which were transforming into small finance banks, also could not escape the brunt of the problem.

Is there a new challenge for the MFIs round the corner? Many in the industry believe so. The origin of the challenge is the so-called “fresh start” process, part of the personal insolvency law. The regulations, part of the Insolvency and Bankruptcy Code 2016, have already been in place but they have not been notified. This will be done over the next few months.

Under the “fresh start” scheme, small borrowers unable to repay unsecured loans up to Rs 35,000 can apply for the automatic debt relief. To qualify for this, the debtors’ gross annual income should not exceed Rs 60,000; the limit for the aggregate value of assets is Rs 20,000. The debtors owning a “dwelling unit” will not qualify for this.

Under Section 80 of the IBC code, the debtors can apply for the relief. The day the application is filed, an interim moratorium on all debt will come into effect and the lenders will not be able to initiate any legal proceedings against such a debt. The debtors need to move the debt recovery tribunals or DRTs for filing such an application and if the relief is given, the debtors come out of bankruptcy and the unsecured loans are waived off.

As a concept, “fresh start” is an integral part of the US insolvency law. Those borrowers who can no longer pay their creditors get a “fresh start” by liquidating assets to pay their debts or by creating a repayment plan. They pay their creditors what they can afford but what they cannot afford is discharged; a debt discharged through bankruptcy is no longer legally enforceable against the debtor. According to the US Supreme Court, “(Bankruptcy) gives to the honest but unfortunate debtor… a new opportunity in life and a clear field for future effort, unhampered by the pressure and discouragement of pre-existing debt.”

Any attempt to collect or coerce payment from such debtors can be penalised by contempt of the bankruptcy court. In the US, this includes a bill through the mail, a telephone call, or a lawsuit. However, a “fresh start” does not “erase” a debt; the discharge is an injunction that makes a debt uncollectible. The debt still remains and may show up on a credit report, but all activity on the debt stops from the day the bankruptcy is filed.

Many in the microfinance industry as well as commercial banks which lend to such institutions apprehend that such a law in India will encourage small unsecured borrowers to default and destroy the credit culture.

The Reserve Bank of India (RBI) stepped in with regulations capping the interest rates, quantum of loans and the number of borrowers a microfinance company can entertain, and formation of credit bureaus, among other things. These brought the industry back from the brink of a collapse. The fact that eight of the 10 small finance banks were microfinance institutions (MFIs) testifies to the resurrection of the industry.

The next blow was demonetisation. In the 50 days between November 10 and December 30, 2016, Rs 15.4 trillion worth of currency notes of denominations of Rs 1,000 and Rs 500 — some 86.9 per cent of the value of the total number of notes in circulation then -- were withdrawn. That hit the microfinance industry hard as till that time most transactions of small loans were in cash. Their loan growth slowed and bad assets zoomed. The MFIs, which were transforming into small finance banks, also could not escape the brunt of the problem.

Is there a new challenge for the MFIs round the corner? Many in the industry believe so. The origin of the challenge is the so-called “fresh start” process, part of the personal insolvency law. The regulations, part of the Insolvency and Bankruptcy Code 2016, have already been in place but they have not been notified. This will be done over the next few months.

Under the “fresh start” scheme, small borrowers unable to repay unsecured loans up to Rs 35,000 can apply for the automatic debt relief. To qualify for this, the debtors’ gross annual income should not exceed Rs 60,000; the limit for the aggregate value of assets is Rs 20,000. The debtors owning a “dwelling unit” will not qualify for this.

Under Section 80 of the IBC code, the debtors can apply for the relief. The day the application is filed, an interim moratorium on all debt will come into effect and the lenders will not be able to initiate any legal proceedings against such a debt. The debtors need to move the debt recovery tribunals or DRTs for filing such an application and if the relief is given, the debtors come out of bankruptcy and the unsecured loans are waived off.

As a concept, “fresh start” is an integral part of the US insolvency law. Those borrowers who can no longer pay their creditors get a “fresh start” by liquidating assets to pay their debts or by creating a repayment plan. They pay their creditors what they can afford but what they cannot afford is discharged; a debt discharged through bankruptcy is no longer legally enforceable against the debtor. According to the US Supreme Court, “(Bankruptcy) gives to the honest but unfortunate debtor… a new opportunity in life and a clear field for future effort, unhampered by the pressure and discouragement of pre-existing debt.”

Any attempt to collect or coerce payment from such debtors can be penalised by contempt of the bankruptcy court. In the US, this includes a bill through the mail, a telephone call, or a lawsuit. However, a “fresh start” does not “erase” a debt; the discharge is an injunction that makes a debt uncollectible. The debt still remains and may show up on a credit report, but all activity on the debt stops from the day the bankruptcy is filed.

Many in the microfinance industry as well as commercial banks which lend to such institutions apprehend that such a law in India will encourage small unsecured borrowers to default and destroy the credit culture.

Disclaimer: These are personal views of the writer. They do not necessarily reflect the opinion of www.business-standard.com or the Business Standard newspaper