The consumption of domestic steel during the period stood at around 62 million tonnes. Till November, consumption was at 52.673 million tonnes, higher by 3.1%.

"Two sectors that contributed to the growth of steel consumption were auto and real estate," said Sushim Banerjee, Director General of the Institute for Steel Development and Growth (INSDAG).

Data provided by the Society of Indian Automobiles, during April-November, show the industry produced a total of 17,799,585 vehicles that include passenger vehicles, commercial vehicles, three wheelers and quadricycle, as against 16,088,825, registering a growth of 10.63% over the same period last year.

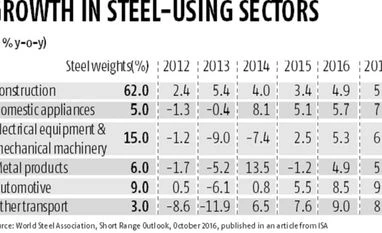

World Steel Association's outlook, however, includes the domestic appliances and electrical equipment as major contributing sectors.

Consumption also increased in newer areas like defence and power projects. "The upgradation in different airports, which is now all steel, gave a further fillip to the industry," Banerjee explained.

In 2015-16, consumption of Indian steel stood at 81.5 million tonnes, which was up by 4.8%. This year would probably end at the same level or a bit higher, but according to the industry, it could have crossed 6% if demonetisation had not happened.

"December is a crucial month. This is the time when consumption picks up," Banerjee pointed out. Demonetisation had affected retail and rural sales, but the major players managed to overcome the crisis by diverting the output to international markets.

SIAM data also show that in December, sales declined by 18.66% on account of demonetisation and year-end impact.

An ICRA reports towards the end of December said that domestic steel demand remained largely stagnant in the first quarter of FY16 with consumption growing by just 0.4% year-on-year but steel consumption growth in the second quarter was much higher at 6.8%.

JSW Director (Commercial & Marketing), Jayant Acharya said that to create demand, public spending has to go up and the direction is expected in the budget.

India's per capita steel consumption is at 59.4 kg compared to a world average of 217 kg in 2014, pointed out, Sanak Mishra, Secretary General and Executive Head of Indian Steel Association.

Going forth, growth in steel consumption is also expected to come from the oil and gas sector as all the pipelines are made of steel.

)