Buyback boost for Infosys shares

The buyback will lead to higher return on equity and payout ratio, said Edelweiss

)

premium

Sources: NSE, BSE; Compiled by BS Research Bureau

Shares of information technology (IT) major Infosys on Thursday posted their biggest jump in nearly nine months after the company said its board would consider a proposal to buy back equity shares.

Strong buying was witnessed in the counter by investors on optimism that the buyback will be at a rate much higher than the prevailing market price, experts said, adding, the buyback amount will be substantial, which would boost the company’s earnings per share (EPS) and return on equity. Shares of Infosys gained 4.54 per cent, the most since November 25, 2016, to close at Rs 1,021.2, the highest level since April 3.

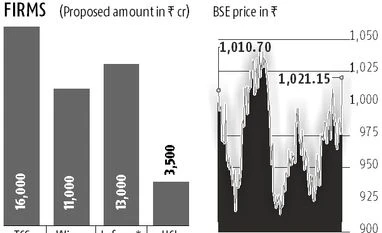

Infosys’ board will meet on Saturday to consider a Rs 13,000-crore share buyback proposal. The buyback has been a long-standing demand by some of the founders and high-profile former executives, who have been pushing the IT major to return surplus capital to its shareholders.

“This has put to rest speculation on the timeline of the buyback. While the quantum and price of buyback is yet to be finalised, the management’s earlier figure of Rs 13,000 crore (including dividend) hints at a much bigger buyback in the offing compared to those by peers TCS, HCL Tech and Wipro,” a note by Edelweiss said.

Strong buying was witnessed in the counter by investors on optimism that the buyback will be at a rate much higher than the prevailing market price, experts said, adding, the buyback amount will be substantial, which would boost the company’s earnings per share (EPS) and return on equity. Shares of Infosys gained 4.54 per cent, the most since November 25, 2016, to close at Rs 1,021.2, the highest level since April 3.

Infosys’ board will meet on Saturday to consider a Rs 13,000-crore share buyback proposal. The buyback has been a long-standing demand by some of the founders and high-profile former executives, who have been pushing the IT major to return surplus capital to its shareholders.

“This has put to rest speculation on the timeline of the buyback. While the quantum and price of buyback is yet to be finalised, the management’s earlier figure of Rs 13,000 crore (including dividend) hints at a much bigger buyback in the offing compared to those by peers TCS, HCL Tech and Wipro,” a note by Edelweiss said.

Sources: NSE, BSE; Compiled by BS Research Bureau