Cipla: Declining India sales lead to a Q1 miss

Margin improvement a silver lining, if sustained, can boost confidence

)

premium

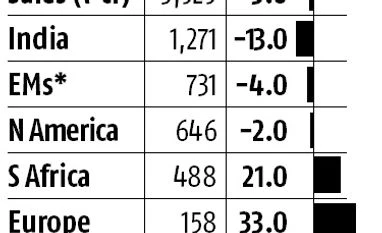

Cipla in the June quarter bore the brunt of de-stocking because of the goods and services tax (GST). Its domestic sales, the largest contributor to revenue at 40 per cent, declined 13 per cent year-on-year (y-o-y) and, as a result, revenue and profitability fell short of the consensus estimate. Net profit may have beaten expectations but it was largely due to higher other income. Revenue, at Rs 3,525 crore, fell 3 per cent y-o-y, and missed the Bloomberg estimate of Rs 3,886 crore.

There are some silver linings, however. For one, looking at the lumpiness in the past, the improvement in operating performance is worth highlighting. Although declining domestic sales had a bearing on earnings before interest, tax, depreciation, and amortisation (Ebitda) and this metric at Rs 646 crore missed the estimates of Rs 671 crore, they still grew 6 per cent y-o-y. Thus, the margins at 18.3 per cent improved 130 basis points y-o-y and 390 bps sequentially, which is positive. Cipla said profitability was driven by significant gross margin improvement and controlled spends. The higher other income of Rs 151 crore (up almost sixfold y-o-y) helped net profit grow 21 per cent y-o-y to Rs 409 crore, beating the estimates of Rs 352 crore. The margin improvement saw the stock gain over a per cent after the results but closed 1.1 per cent lower at Rs 542.70 due to the broad-based selling in markets.

There are some silver linings, however. For one, looking at the lumpiness in the past, the improvement in operating performance is worth highlighting. Although declining domestic sales had a bearing on earnings before interest, tax, depreciation, and amortisation (Ebitda) and this metric at Rs 646 crore missed the estimates of Rs 671 crore, they still grew 6 per cent y-o-y. Thus, the margins at 18.3 per cent improved 130 basis points y-o-y and 390 bps sequentially, which is positive. Cipla said profitability was driven by significant gross margin improvement and controlled spends. The higher other income of Rs 151 crore (up almost sixfold y-o-y) helped net profit grow 21 per cent y-o-y to Rs 409 crore, beating the estimates of Rs 352 crore. The margin improvement saw the stock gain over a per cent after the results but closed 1.1 per cent lower at Rs 542.70 due to the broad-based selling in markets.