For the past couple of months, yields have remained at a higher level, though the government’s decision to truncate its debt programme in April-September, 2018, helped the bond market, to some extent, in the last few days of FY18. Since yields and bond prices are inversely related, the high-yield trajectory impacts bond issuance. Nevertheless, the management expects recent regulatory changes and policy announcements, intended to increase participation and strengthen India’s corporate bond market, to augur well for the bond market in the long-term.

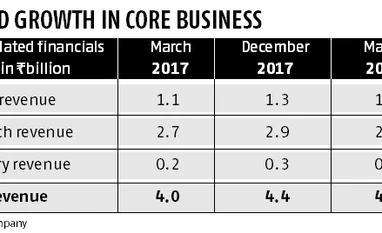

Besides, according to the management, CRISIL’s revenue from the research segment, accounting for over 65 per cent of its total pie, increased marginally by 3.1 per cent year-on-year (over a year ago quarter) and fell by 4.6 per cent sequentially, owing to the seasonality factor. Even the margin from this segment contracted by 20-30 basis points.

A feeble performance by the rating and research segments restricted CRISIL’s overall top line growth to just 4.6 per cent year-on-year. The company, however, reported a 14 per cent jump in the net profit year-on-year and expanded its margins by 161 basis points because of greater efficiencies and cost control measures (mainly due to automation).

The management expects changes in external environment to improve demand for its offerings. CRISIL is positioned well to capture opportunities as and when they arise.

The positives, according to analysts at Elara Capital, are acceleration in revenue growth (Rs 13 per cent), ability to turnaround acquisition in non-rating business, and stable performance from existing businesses. They see a 18-20 per cent upside in the stock by December 2019.

)