Flipkart on the cusp of a big churn

The entry of Amazon pushed Flipkart into a corner but Flipkart is getting its act together

)

premium

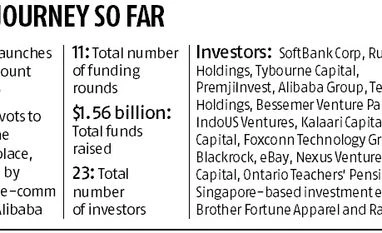

The journey so far

Masayoshi Son, the 60-year-old founder and managing director of SoftBank, is patient enough to wait for decades to see returns on investments made in start-ups. He is also quick to exit the ones that do not show promise.

In India, he bet on Snapdeal, the Gurugram-based digital marketplace he identified in 2014 to take on rival Flipkart in the country’s booming e-commerce space. He invested $900 million in the company over two years.

Early this year, he decided his focus was misdirected. SoftBank has written off the investments in Snapdeal, and is now in talks to invest $1 billion in Flipkart, as part of a deal to merge the two online retailers.

SoftBank is getting on board Kalaari Capital and Nexus Venture Partners, both investors in Snapdeal, to hasten the sale. And, will remain an active investor in India’s e-commerce market. Son is aiming to repeat a bet he made in Alibaba, when it was a fledgling company in China.

While the value of investing in Flipkart is somewhat obscure, Son sees opportunities for a larger return later. After all, in the decade of its existence, Flipkart has more data and insights on online customer behaviour than any other in the country.

The entry of Amazon, with a $5-billion cheque and superior service, pushed both Snapdeal and Flipkart into a corner but Flipkart is getting its act together.

It outperformed Amazon during festive sales last year and has started to regain investor confidence. On Monday, Tencent, Microsoft and eBay invested $1.4 billion in the company, valuing it at $11.6 billion.

The merger could help Flipkart thwart the challenge from Amazon, though there are no gains for the founders (the Bansals of Flipkart and Kunal Bahl of Snapdeal).

According to RedSeer Consulting, Snapdeal would enable Flipkart to expand its supply chain quickly with its numerous small and big warehouses, especially in north India.

“Fast deliveries and regional fulfilment of orders have become crucial for e-retailers to achieve both higher customer satisfaction and lower supply chain costs. This move by Flipkart would be a significant boost to its quest for supply chain leadership over Amazon, which is aggressively expanding its supply chain network,” it said in a report.

In India, he bet on Snapdeal, the Gurugram-based digital marketplace he identified in 2014 to take on rival Flipkart in the country’s booming e-commerce space. He invested $900 million in the company over two years.

Early this year, he decided his focus was misdirected. SoftBank has written off the investments in Snapdeal, and is now in talks to invest $1 billion in Flipkart, as part of a deal to merge the two online retailers.

SoftBank is getting on board Kalaari Capital and Nexus Venture Partners, both investors in Snapdeal, to hasten the sale. And, will remain an active investor in India’s e-commerce market. Son is aiming to repeat a bet he made in Alibaba, when it was a fledgling company in China.

While the value of investing in Flipkart is somewhat obscure, Son sees opportunities for a larger return later. After all, in the decade of its existence, Flipkart has more data and insights on online customer behaviour than any other in the country.

The entry of Amazon, with a $5-billion cheque and superior service, pushed both Snapdeal and Flipkart into a corner but Flipkart is getting its act together.

It outperformed Amazon during festive sales last year and has started to regain investor confidence. On Monday, Tencent, Microsoft and eBay invested $1.4 billion in the company, valuing it at $11.6 billion.

The merger could help Flipkart thwart the challenge from Amazon, though there are no gains for the founders (the Bansals of Flipkart and Kunal Bahl of Snapdeal).

According to RedSeer Consulting, Snapdeal would enable Flipkart to expand its supply chain quickly with its numerous small and big warehouses, especially in north India.

“Fast deliveries and regional fulfilment of orders have become crucial for e-retailers to achieve both higher customer satisfaction and lower supply chain costs. This move by Flipkart would be a significant boost to its quest for supply chain leadership over Amazon, which is aggressively expanding its supply chain network,” it said in a report.

The journey so far