Hindalco: Volatile aluminium prices, rising imports remain major concerns

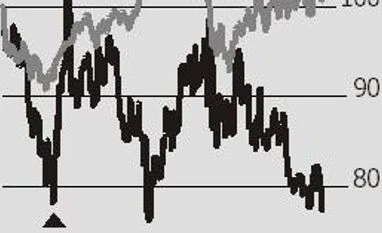

The average per tonne aluminium price on the London Metal Exchange (LME) during the quarter, at $1,968, was down 4.5 per cent sequentially and 6.5 per cent year-on-year (YoY)

)

premium

After a strong performance by its US subsidiary Novelis, Hindalco’s domestic performance, too, was in line with expectations despite multiple challenges. Aluminium prices have remained volatile on the back of global trade war concerns, with domestic prices trending down amid rising imports.

The average per tonne aluminium price on the London Metal Exchange (LME) during the quarter, at $1,968, was down 4.5 per cent sequentially and 6.5 per cent year-on-year (YoY). Even domestic per tonne premiums softened to $74 from $84 in the previous quarter and $95 in the year-ago quarter.

The quarter also saw imports of aluminium, including scrap, at 607,000 tonnes — up 20 per cent YoY. Thus, while aluminium production remained stable and alumina production rose 2 per cent YoY, aluminium sales were down slightly at 323,000 tonnes and below estimates (ICICI Securities estimated 330,000 tonnes).

The average per tonne aluminium price on the London Metal Exchange (LME) during the quarter, at $1,968, was down 4.5 per cent sequentially and 6.5 per cent year-on-year (YoY). Even domestic per tonne premiums softened to $74 from $84 in the previous quarter and $95 in the year-ago quarter.

The quarter also saw imports of aluminium, including scrap, at 607,000 tonnes — up 20 per cent YoY. Thus, while aluminium production remained stable and alumina production rose 2 per cent YoY, aluminium sales were down slightly at 323,000 tonnes and below estimates (ICICI Securities estimated 330,000 tonnes).