HUL's Q2 revenue, net profit rise as business back to normal level

A poll of analysts done by Bloomberg had pegged the firm's net profit at Rs 1,915 crore

)

premium

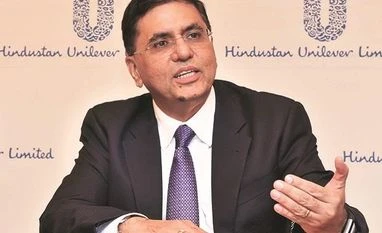

“Rural markets have been resilient and continue to do better than urban areas. Though the worst is behind us, we are cautiously optimistic on demand recovery," said Sanjiv Mehta, Chairman & MD, HUL

3 min read Last Updated : Oct 21 2020 | 1:16 AM IST

Hindustan Unilever (HUL), the country's largest consumer goods company, appears to have put the challenges emanating from the Covid-19 pandemic and lockdown firmly behind it.

On Tuesday, the company reported an 8.7 per cent year-on-year increase in net profit to Rs 2,009 crore for the July-September period (Q2), beating Street estimates by a wide margin.

A poll of analysts done by Bloomberg had pegged the firm's net profit at Rs 1,915 crore. Its revenue for the quarter rose 16.1 per cent from a year ago to Rs 11,442 crore.

Consensus estimates by Bloomberg had pegged the revenue at Rs 11,138 crore for the quarter. HUL said the numbers were not strictly comparable since it took into account the nutrition business acquired from GSK Consumer last year.

Excluding the nutrition portfolio, HUL's top line growth was 3 per cent for the quarter, with volume growth at 1 per cent and price-led growth at 2 per cent. Despite this, analysts tracking the company said HUL had delivered a good set of numbers, given that urban markets continued to experience weakness compared with rural areas. About 60 per cent of HUL's sales come from urban areas and the rest from rural markets.

"HUL's performance was largely in line with our expectations barring the 1 per cent miss on volume growth," said Kaustubh Pawaskar, associate vice-president (research) at brokerage Sharekhan. "80 per cent of the company's portfolio, which includes health, hygiene, and nutrition products, registered double-digit growth.

Discretionary and out-of-home categories, however, continued to post declines," he said. Sanjiv Mehta, chairman and managing director, HUL, said he remained cautiously optimistic about consumer demand in the quarters ahead. "While operations and service levels are now back to pre-Covid levels, demand in urban India, especially in metropolitan cities, has been muted. Rural markets have been resilient and continue to do better than urban areas. Though the worst is behind us, we are cautiously optimistic on demand recovery," Mehta said.

The company's earnings before interest, tax, depreciation and amortisation (Ebitda) for the quarter grew by 17 per cent year-on-year to Rs 2,869 crore, and margins improved by 30 basis points in comparison to last year.

"A strong savings programme and a judicious and calibrated pricing in tea and synergies in nutrition have enabled us to successfully manage commodity inflation and an adverse product mix," Srinivas Phatak, chief financial officer, HUL, said. "We have significantly increased investments behind brands to remain competitive," he said.

Among segments, food and refreshment registered an 83 per cent year-on-year growth in revenue to Rs 3,379 crore with its earnings before interest and tax (EBIT) rising 90 per cent and margins expanding 60 basis points year-on-year.

The beauty and personal care division reported a 0.2 per cent year-on-year decline in revenue to Rs 4,535 crore, but its EBIT increased 1 per cent with margin expansion of 40 basis points versus last year.

HUL reported a 1.6 per cent year-on-year decline in its home care revenue to Rs 3,318 crore, but EBIT increased 13.9 per cent and margins rose 280 basis points versus last year. Phatak said the company had taken price cuts in its fabric wash (detergents) business, passing on gains made on account of benign crude oil prices seen during the quarter.

The company declared an interim dividend of Rs 14 per share for the period ended September 2020.

HUL's stock closed trade at Rs 2,172.10 per share on Tuesday, down 0.31 per cent on the BSE.

Topics : Hindustan Unilever Q2 results