IDFC First's downside limited, but analysts divided on bank's future

Faster-than-expected loan growth could lift valuations for bank

)

premium

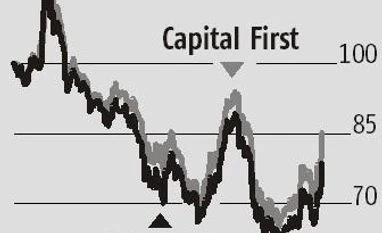

Shares of IDFC Bank and Capital First were up 4 per cent each, after the announcement that the merged entity — to be called IDFC First Bank — has commenced operations.

The combined entity is headed by V Vaidyanathan, founder and chairman of Capital First.

Analysts believe that the IDFC Bank stock (Capital First is merging into this), which has shed 21 per cent over the last year, has bottomed out.

“Currently trading at around its book value, I don’t see further downside for the stock,” says G Chokkalingam, founder of Equinomics Research.

The question, however, is whether investors should be lured by valuations in anticipation of improvement in financials.

The Street is divided on this. Since its inception, the bank has worked its way in terms of deposit growth, loan growth and bad loans.

While the bank closed the recently gone by September quarter (Q2) in red with a loss of Rs 3.7 billion, its net non-performing assets (NPA) has reduced from 1.6 per cent a year ago to 0.6 per cent.

The combined entity is headed by V Vaidyanathan, founder and chairman of Capital First.

Analysts believe that the IDFC Bank stock (Capital First is merging into this), which has shed 21 per cent over the last year, has bottomed out.

“Currently trading at around its book value, I don’t see further downside for the stock,” says G Chokkalingam, founder of Equinomics Research.

The question, however, is whether investors should be lured by valuations in anticipation of improvement in financials.

The Street is divided on this. Since its inception, the bank has worked its way in terms of deposit growth, loan growth and bad loans.

While the bank closed the recently gone by September quarter (Q2) in red with a loss of Rs 3.7 billion, its net non-performing assets (NPA) has reduced from 1.6 per cent a year ago to 0.6 per cent.