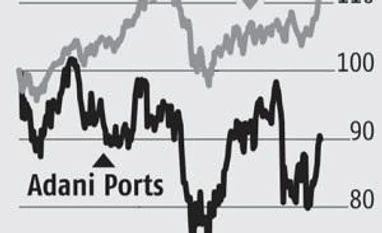

Inter-group transactions, debts once again weigh on Adani Ports stock

While the stock trades at 30-35% discount to its historic valuation, inter-corporate transactions and debt remain an overhang

)

premium

3 min read Last Updated : Mar 15 2019 | 1:04 AM IST

Adani Ports and Special Economic Zone (Adani Ports) is among the most sold stock by domestic investors in February 2019, according to the recent data.

For analysts who were always wary of the company’s debt levels, inter-group loans and advances, and shareholding pledged by its promoters, these concerns once again resurface with the Adani Agri Logistics’ (AAL) acquisition.

The deal hasn’t been welcomed by analysts despite it promising inroads into the logistics sector, given that AAL has 45 per cent market share in modern agri-storage infrastructure. The deal’s value at 11.6 times enterprise value to earnings before interest and tax, or simply operating profit, has drawn the Street’s flak.

“Since there is always some premium for an acquisition, it is the possibility of overpaying for a group company that was being probed via questions,” analysts at Jefferies note in a post-deal analyst call.

Consequently, Citi has downgraded the stock from ‘buy’ to ‘neutral’, as it says the acquisition might lead to a resurgence of investor concern around related party transactions and capital allocation. This is why even if the business fundamentals are strong and AAL holds leadership position in the port logistics industry, the stock (Adani Ports) is losing its appeal.

For instance, after a weak September quarter, the December quarter (third quarter or Q3) was once again a strong show by India’s largest private sector ports operator. With total volumes touching 154 million tonne (mt) in Q3, analysts are confident that Adani Ports will meet its 2018-19 target of 200 mt. Led by 11 per cent volume growth in Q3, revenues grew by 5 per cent, while net profit jumped 31 per cent, driven by gains from derivative instruments.

ALSO READ: Adani's port projects catch a tailwind

Operating profit margin, on a sequential basis, remained flat at 65.3 per cent, off the historic 70 per cent average, as new ports are now contributing more meaningfully. Dependence on Mundra, Adani Ports’ flagship port, has gradually reduced and was at 65 per cent of volumes in Q3.

Smaller and newer ports, acquired in the last 3 – 5 years such as Kattupalli, Dhamra, Goa, and Tuna, grew faster by 9-25 per cent as against Mundra’s 6 per cent year-on-year volume growth, positioning Adani Ports favourably ahead of the industry.

However, a domestic fund manager says these fundamentals are priced in. “Unless clarity emerges on capital allocation and inter-group transactions, the stock may remain under pressure,” he adds. Therefore, even if current valuations at 30–35 per cent discount to historic levels seem appealing, these concerns override valuations.