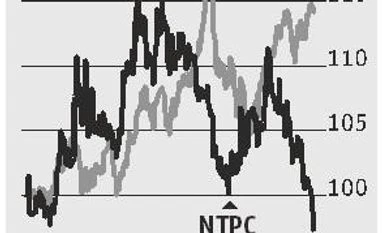

NTPC stock: Concerns likely to ease in the coming months

Concerns may ease in the coming months and there are multiple earnings trigger for the stock

)

premium

The NTPC stock touched its lowest level in 52 weeks on Friday, and ended on Monday with marginal gains. Concerns over coal availability at some of its power plants has kept the Street worried. If analysts are to be believed, it may be a good time for investors to buy into this correction.

While it is too early to comment on the possibility of return on equity (RoE) declining in the new regulatory regime, the low project internal rate of return (12 per cent) against the prevailing cost of equity (11-12 per cent) leaves little room for further cuts.

On coal availability at some plants, JM Financial expects the situation to improve by the first half of FY19, considering the efforts by NTPC and the power, coal and railway ministries.

While it is too early to comment on the possibility of return on equity (RoE) declining in the new regulatory regime, the low project internal rate of return (12 per cent) against the prevailing cost of equity (11-12 per cent) leaves little room for further cuts.

On coal availability at some plants, JM Financial expects the situation to improve by the first half of FY19, considering the efforts by NTPC and the power, coal and railway ministries.