Reliance looks at Nasdaq listing for Jio Platforms; IPO likely by 2021

Morgan Stanley is likely to be appointed the lead banker to manage the overseas listing, while Bank of America Merrill Lynch and Citibank may also be roped in for the IPO, another source informed.

)

premium

In the past one month, five global players have picked up a 17.12 per cent stake in Jio Platforms for a total consideration of Rs 78,562 crore, valuing the company at Rs 4.91 trillion (or $73 billion).

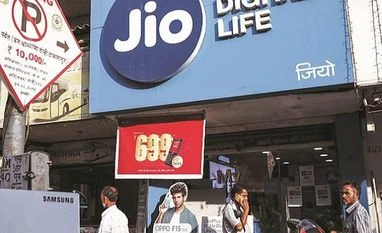

An overseas listing may be on the cards for Jio Platforms, the digital and telecommunications subsidiary of Reliance Industries (RIL). According to sources aware of the development, work in this regard may commence soon after RIL sells 20-25 per cent in Jio Platforms and the government issues direct listing guidelines.

In the past one month, five global players have picked up a 17.12 per cent stake in Jio Platforms for a total consideration of Rs 78,562 crore, valuing the company at Rs 4.91 trillion (or $73 billion).

Highly placed sources said once the new guidelines for direct international listing were announced by the government, the company would look at various global stock markets. On May 17, Finance Minister Nirmala Sitharaman had said Indian companies might be allowed direct overseas listing, without a simultaneous listing in the Indian market. Detailed guidelines are still in the works.

In the past one month, five global players have picked up a 17.12 per cent stake in Jio Platforms for a total consideration of Rs 78,562 crore, valuing the company at Rs 4.91 trillion (or $73 billion).

Highly placed sources said once the new guidelines for direct international listing were announced by the government, the company would look at various global stock markets. On May 17, Finance Minister Nirmala Sitharaman had said Indian companies might be allowed direct overseas listing, without a simultaneous listing in the Indian market. Detailed guidelines are still in the works.