Vedanta posts 17 per cent growth in aluminium production for FY19

The spike in aluminium output was also helped by volume growth at Vedanta's Lanjigarh alumina refinery

)

premium

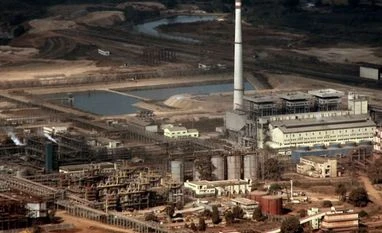

Vedanta's aluminium refinery at Lanjigarh, Odisha, seen from the Niyamgiri Hills

Diversified metals & mining conglomerate Vedanta Ltd has posted a 17 per cent growth in aluminium production, buoyed by stabilisation and ramp-up of its smelters at Jharsuguda (Odisha). In volume terms, aluminium output in the last fiscal was 1.95 million tonnes (mt), its best ever, outstripping FY18's 1.67 mt, making Vedanta, the country's largest producer of the white metal, upstaging Hindalco Industries.