Vedanta: Triggers outweigh worries

Power unit closures to have marginal impact, while volume growth and firm realisations in metals and oil businesses will continue driving earnings

)

premium

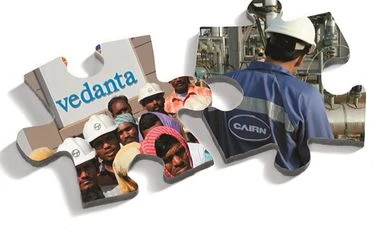

Cairn-Vedanta merger

The Vedanta stock may have come off its peak seen in the last fortnight of September, but the company’s business prospects remain firm. The temporary closure of almost half of its captive power capacities (1,605 MW out of 3,615 MW) at Odisha aluminium smelter due to environmental reasons is one factor that has impacted street sentiment, but broader markets too have been under pressure. Nevertheless, analysts don’t see much impact of the power capacity closure till remaining capacities are functional and the matter does not aggravate further. Positively, aluminium prices are expected to remain firm and so are other base metal prices. Added to these are benefits of capacity ramp-ups and also of-late the prospects of its oil and gas business, which falls under its subsidiary Cairn India, owing to improved crude oil prices. All these suggest that any correction in the share price offers a good investment opportunity for investors.