Advertising revenue for the financial year under consideration grew 19.8 per cent, from Rs 4,204.8 crore in FY18 to Rs 5,036.7 crore. The company attributed this revenue traction to the strengthening of its domestic broadcast business’ market share and monetisation of ZEE5’s fast growing user base.

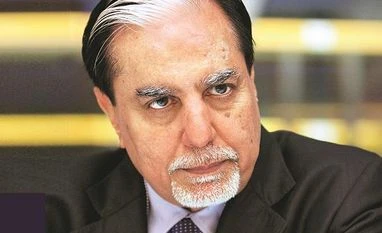

Subhash Chandra, chairman, ZEEL, commented, “This has been another year of robust performance and we have ended the year on a strong footing. With the elections behind us, I expect the economic growth to accelerate. Our M&E industry has grown tremendously over the last few years, but I believe that it is just the beginning. Entertainment content is becoming increasingly personalised and that journey will continue with the new Telecom Regulatory Authority of India (Trai) regulation and emergence of digital medium placing consumer at the centre. This will further motivate all the content producers to create better quality content.”

Subscription revenue was Rs 2,310.5 crore, up 13.9 per cent, from Rs 2,028.7 crore in FY18. Domestic subscription revenues for 2018-19 (FY19) at Rs 1,923.2 crore grew by 17.4 per cent year-on-year (YoY). While the first nine-month growth was 22.5 per cent led by the monetisation of phase-III subscribers, the full-year growth came down due to the impact of Trai tariff order in the fourth quarter (Q4). International subscription revenue at Rs 387.3 crore was flat on a YoY basis.

Programming cost for FY19 increased by 21.7 per cent YoY to Rs 3,075.8 crore, driven by content cost for ZEE5 which is not there in the base year FY18, increase in programming cost for domestic broadcast business due to higher movie amortisation cost for Hindi and regional channel portfolio, increase in original programming hours in regional markets, and elevated costs for the movie production and distribution business.

Advertising, publicity, and other expenses for the year grew 10.8 per cent YoY to Rs 1,569.2 crore, despite a higher base, due to increase in marketing and promotion costs associated with ZEE5, new channel launches (Zee Keralam, Zee Keralam HD, Zee Kannada HD), and brand refresh campaign of one English and several regional channels during the year.

Consolidated operating revenue for Q4FY19 stood at Rs 2,019.3 crore, recording a growth of 17.0 per cent over Q4FY18 (Rs 1725.3 crore). Ebitda for the quarter was Rs 568.3 crore, with a margin of 28.1 per cent. PAT for the quarter was Rs 291.7 crore, up 26.3 per cent over the corresponding quarter last financial year.

In Q4, ZEEL’s consolidated advertising revenue grew 16 per cent YoY to Rs 1,217.5 crore. Domestic advertising revenues at Rs 1,157.5 crore witnessed a growth of 17.7 per cent. The domestic advertising revenue growth was slower than the previous quarters as the brands pulled back on advertising spends due to uncertainty related to Trai tariff order implementation. While television advertising witnessed slowdown, overall domestic advertising revenue was aided by the company’s emerging digital business ZEE5.

ZEEL’s consolidated subscription revenue grew 3.4 per cent to Rs 565.3 crore during the quarter under consideration. Domestic subscription revenue grew 3.9 per cent YoY, while international subscription revenue witnessed a growth of 1.4 per cent YoY at Rs 95.7 crore. Domestic subscription revenue during the quarter was affected by the implementation of the Trai tariff order. There were multiple shifts in the implementation timelines, which led to a period of uncertainty for both the distributors and consumers. There were also execution challenges as the distributors’ back-end infrastructure took time to adapt to the enormous number of consumer requests.

Punit Goenka, managing director & chief executive officer, ZEEL, said, “The subscription and advertising revenues for Q4 were impacted due to the tariff order. However, our medium-term growth outlook for the business remains unchanged. While the advertisers have been circumspect to spend due to the uncertainty caused by the regulation and some moderation in the consumer demand, we believe this is temporary. The tariff order should settle soon and the new government’s primary objective will be to stimulate consumer demand, both of which will inspire confidence in the advertisers. The new subscription regime would be beneficial for all the stakeholders in the value chain.”

)