Zomato fund infusion positive for Info Edge

Higher competitive pressures, though, will keep 99acres' profits under check

)

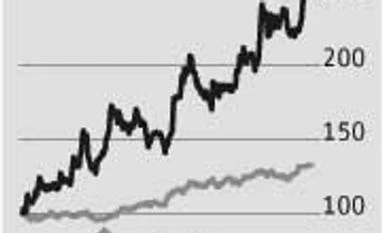

The Info Edge scrip scaled to an all-time intra-day high of Rs 1,014.7 on Wednesday after the company announced further fund infusion of Rs 185 crore in Zomato Media Private Limited, which owns and operates its online food guide portal, zomato.com. While the move signals an uptick in Zomato’s valuations, analysts say the cash will enable higher growth for the online food guide portal.

The total fund infusion (along with two other investors), which also involves purchase of some shares from existing shareholders, is Rs 370 crore and will push up Zomato’s post-fund-raising valuations from an estimated $500 million to $670 million, believes Ashish Chopra, e-commerce analyst at Motilal Oswal Securities. After this and adjusting for the cash outgo from Info Edge, Zomato will contribute Rs 150 a share to Info Edge’s sum-of-the-parts valuation versus Rs 125 a share earlier, estimates Chopra who has a target price of Rs 1,125 on the stock.

While the news on Zomato is positive, for 99acres.com, the real estate classifieds portal of Info Edge, expect competition to intensify led by presence of five to six players. Its smaller peer housing.com reportedly raised money from Japan-based SoftBank recently, valuing it close to Rs 1,500 crore. Info Edge, too, plans to infuse about Rs 750 crore in 99acres.com to improve product quality and user experience, which Edelweiss’ analysts said (last month) will be beneficial in the long run. Notably, this segment has significant growth potential given the highly underpenetrated industry, which is also visible in 99acres’ recent performance. While the total listings have been rising in the past two quarters, the paid transactions (albeit a small number compared to total listings) have jumped 50 per cent in past four quarters to about 22,000 in September quarter. Analysts though say, given the competition, 99acres break-even may take six to eight quarters. Retaining its market share of about 35 per cent, increasing stickiness and traffic on the website and improving profitability, are key monitorables. For now, given the smaller size of housing.com and unavailability of its financials, analysts believe it will be difficult to draw parallels from this deal and its possible rub-off on 99acres' valuations.

Meanwhile, Info Edge's main business of recruitment (through naukri.com) witnessed improved traction in the September 2014 quarter and stands to gain from economic recovery. Going forward, analysts expect its revenues and net profit to grow at a compounded annual rate of 24.6 per cent and 35 per cent, respectively over FY14-16. While naukri.com will continue to be the main contributor to profits, scaling up and monetising of smaller businesses will be the key catalyst for Info Edge. Higher than anticipated write-offs in investee firms remains a risk.

With long-term growth prospects strong, most analysts remain positive on Info Edge. However, as per recent Bloomberg data, their average target price stands at Rs 885, implying downside of 7.4 per cent from current levels of Rs 956.

The total fund infusion (along with two other investors), which also involves purchase of some shares from existing shareholders, is Rs 370 crore and will push up Zomato’s post-fund-raising valuations from an estimated $500 million to $670 million, believes Ashish Chopra, e-commerce analyst at Motilal Oswal Securities. After this and adjusting for the cash outgo from Info Edge, Zomato will contribute Rs 150 a share to Info Edge’s sum-of-the-parts valuation versus Rs 125 a share earlier, estimates Chopra who has a target price of Rs 1,125 on the stock.

Meanwhile, Info Edge's main business of recruitment (through naukri.com) witnessed improved traction in the September 2014 quarter and stands to gain from economic recovery. Going forward, analysts expect its revenues and net profit to grow at a compounded annual rate of 24.6 per cent and 35 per cent, respectively over FY14-16. While naukri.com will continue to be the main contributor to profits, scaling up and monetising of smaller businesses will be the key catalyst for Info Edge. Higher than anticipated write-offs in investee firms remains a risk.

With long-term growth prospects strong, most analysts remain positive on Info Edge. However, as per recent Bloomberg data, their average target price stands at Rs 885, implying downside of 7.4 per cent from current levels of Rs 956.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Nov 19 2014 | 9:36 PM IST