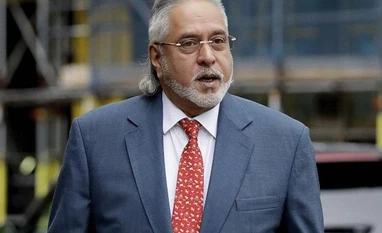

Vijay Mallya denied permission to appeal in UK bankruptcy case

Vijay Mallya denied permission to appeal against a UK High Court order refusing to dismiss bankruptcy proceedings brought by a consortium of Indian banks led by the State Bank of India (SBI)

)

Liquor tycoon Vijay Mallya was on Wednesday denied permission to appeal against a UK High Court order refusing to dismiss bankruptcy proceedings brought by a consortium of Indian banks led by the State Bank of India (SBI), in their pursuit of debt related to his now-defunct Kingfisher Airlines.

The 65-year-old businessman, who remains on bail in the UK, had filed a renewed application to appeal against UK court orders in the case from last year, which had allowed for an adjournment of bankruptcy proceedings until the debt issue before the Supreme Court in India was decided upon.

His counsel, Philip Marshall, argued that the banks' bankruptcy petition should be dismissed rather than just adjourned as the debt in question was disputed and being deliberated upon in the Indian courts.

While this was a new point [before the appellate court], I do not accept it as a reasonable ground for appeal as the matter can be dealt with during proceedings that are still continuing, said Justice Colin Birss, during a remote hearing of the Chancery Appeals Division of the High Court in London.

Mallya's barrister also raised the issue of "abuse of process" by the banks in their alleged non-disclosure of securities held in India and the existence of third-party security in the form of assets related to United Breweries Holdings.

Also Read

The judge reiterated that he had dismissed both these as sufficient grounds of appeal in a ruling he handed down on paper in December last year.

There is no prospect of success of an appeal based on this ground, although this does not preclude reliance on it [third-party security] later, the judge ruled.

The hearing forms part of a series being heard by the High Court since the SBI-led consortium of 13 Indian banks had initiated the proceedings against Mallya in December 2018 as part of their efforts to recoup around 1.145 billion pounds in unpaid loans.

Both sides have deposed retired Indian Supreme Court justices as expert witnesses on Indian law in support of their arguments for and against a bankruptcy order against Mallya in the UK.

While the banks argue a right to waive their security over the Indian assets involved in the case in order to recover their debt in the UK, lawyers for Mallya argue that the funds in question involved public money held by state-owned banks in India which precluded them from such a security waiver.

The next hearing to conclude closing submissions in the case is scheduled to be heard at a yet-to-be-agreed date in the coming weeks.

In parallel, Mallya's lawyers have also been applying to the court in order for him to meet his considerable and mounting legal costs from monies held with the Court Funds Office (CFO) as part of the bankruptcy proceedings.

In the last hearing related to costs on Monday, Judge Sebastian Prentis at the Insolvency and Companies Court (ICC) division of the High Court had agreed only to allow sufficient funds to cover the hearing on Wednesday.

The issue of funds held by the court will now be fully dealt with at a hearing listed before the High Court on January 22, during which it will be decided whether to sanction sums towards living expenses and legal fees from the sale of a French luxury property Le Grand Jardin last year.

Meanwhile, the separate proceedings related to the former Kingfisher Airlines chief being extradited to India to face charges of fraud and money laundering remain held up by a confidential legal matter.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jan 13 2021 | 8:09 PM IST