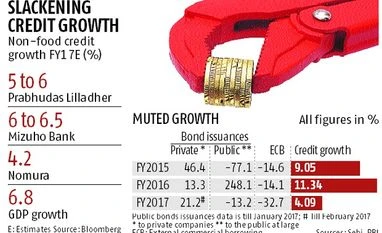

For FY17, the Street expects credit growth to be between 4.2 per cent and 6.5 per cent. This ends lower than the Bloomberg consensus estimate of 6.8 per cent GDP growth this fiscal year.

“While there has been a two-three per cent growth impact due to demonetisation, we believe a larger growth drag comes from corporate deleveraging, which is unlikely to abate soon,” says Adarsh Parasrampuria, banking analyst at Nomura. Slowing mortgages could be a medium-term risk, especially if government incentives are not able to revive housing demand, he added.

The rate of growth of mortgage loans has come down to 10 per cent in FY17 so far from 15.2 per cent at the same time in the last fiscal year, analysts estimate.

“Lower capex activity, UDAY (Ujwal Discom Assurance Yojana) repayments and banks’ risk aversion as regards large credit will keep overall credit growth muted,” say analysts at domestic brokerage Prabhudas Lilladher.

Some market participants say the growing presence of non-bank financial companies (NBFCs) is another reason for the lower growth in bank credit. But economists differ. Tirthankar Patnaik, India Strategist, Mizuho Bank, says, “NBFCs depend on banks and bond markets for capital, which they then lend to borrowers in the retail, corporate and other segments. Hence, including them in the overall credit numbers might lead to some duplication.”

There is an aspect that needs to be factored in while assessing credit growth. As the fall in bond yields outpaced that in bank interest rates, this fiscal year witnessed a significant jump in corporate borrowings through bond issuances. According to the Sebi (Securities and Exchange Board of India) data, bond issuances to the private sector stood at Rs 5.55 lakh crore in FY17 so far and have already surpassed the Rs 4.58 lakh crore in FY16. However, even if one includes this in overall credit growth, the number is still at a multi-year low and could be, at best, in line with GDP growth. This is because bond markets are a relatively small part of overall credit and hence cannot make much difference to the headline number. The non-food credit stood at Rs 65.79 lakh crore till December 2016, much higher than the bond issuances (including public) of Rs 5.08 lakh crore till then.

Borrowings from international markets through external commercial borrowings (ECBs) and other instruments too have not grown in the past four-five months and reflect the stagnant credit needs of companies. ECBs have fallen almost 33 per cent year-on-year in FY17 so far.

The worrying aspect is that credit growth is not seen picking up anytime soon.

Patnaik says: “Private companies’ capacity utilisation is still at 70-72 per cent levels. Unless this metric goes up to 80-85 per cent, corporate capex will not pick up. If consumption growth remains at current levels, capacity utilisation will start moving up. This process might take 12-18 months.”

Weakening credit growth also indicates there could be further downside risks to the current GDP growth estimates.

)