Dependence on imports in the steel sector is worrisome: R C P Singh

Newly appointed Steel Minister says the announcement of the Rs 6,322-cr PLI scheme for specialty steel is another step towards 'Atmanirbhar Bharat'

)

premium

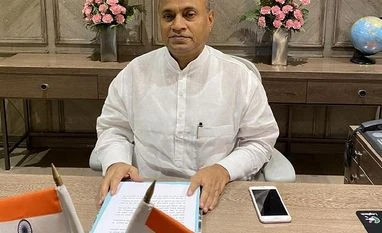

Newly-appointed Steel Minister R C P Singh

7 min read Last Updated : Jul 26 2021 | 12:15 PM IST

Ram Chandra Prasad Singh, a former Indian Administrative Service officer of 1984 batch, is the face of Nitish Kumar-led Janata Dal (United) in the Narendra Modi government. He has taken charge of the Union Ministry of Steel at a time when the sector is on an upcycle. In an interview with Jyoti Mukul, Singh talks about two recent government decisions on production linked incentive (PLI) and coking coal imports from Russia, and the tightrope walk between free pricing and high cost of steel. Edited excerpts:

What are the key challenges that you intend to focus on?

What is most worrisome is our dependence on imports. Currently, we are spending about Rs 75,000 crore on import of coking coal and around Rs 30,000 crore on import of specialty steel. We are spending Rs 1 trillion on imports. We have to work towards reducing these imports. To address both these, we have got two Cabinet approvals. One was to enter into a MoU with Russia for importing coal to India and diversify supply. The announcement of the PLI scheme for specialty steel is also a step towards Atmanirbhar Bharat.

Ensuring safety in an industry, like steel, is also a challenge. Though we have issued 25 safety guidelines in February 2020 for the steel sector, these are voluntary. We have to ensure that these guidelines are formalized by the ministry of labour so that they are mandatory.

Financial infusion and liquidity in the steel sector also poses a challenge for the sector especially for the smaller players. I would like to see how best this issue can be addressed.

The other aim is to reduce the carbon footprint while staying globally competitive. Our major production is through the Blast Furnace-Basic Oxygen Furnace (BF-BOF) route. We have committed to bring down greenhouse gas emission to a level of 2.2 tonne-2.4 tonne for a tonne of crude steel in the BF-BOF route by 2030-31. We have reached a level of 2.5 tonne by adopting innovative technologies but we want our industry to be at par with global peers

How far will Rs 6,322-crore PLI help the steel players that have put up specialty steel plants?

The scheme has been formulated after considering the needs of the industry and the country. While steel producers will be incentivised for producing value added steel, India’s import dependence will reduce and export capability will improve. At present, 18 million tonne of specialty steel is manufactured in the country out of a total steel production of 102 million tonne. Several steel players both integrated steel plants and others are into the business of making specialty steel. There are some product categories, like specialty rails, CRGO, API grade steel, etc, which are not manufactured at all or manufactured in very limited quantities. We expect that the PLI incentive of Rs 6,322 crore will help the existing players or the ones who would now like to enter into this arena.

What are the government estimates of investment in the steel sector and especially the specialty steel segment?

It is estimated that to achieve the 300 million tonne capacity by 2030-31, Rs 8-10 trillion of investment would be needed by the steel sector. As far as specialty steel is concerned, the investment needed to achieve the 42 million tonne production by 2026-27 is about Rs 40,000 crore.

Will the estimated specialty steel production of 42 mt by 2027 help in meeting the entire demand after the next five years?

The production of 42 million tonne by the end of the scheme in 2027 will not only meet India’s specialty steel demand, but also export demand. Domestic players of these products would enter the global market, thereby enhancing exports from the current 1.7 million tonne to an expected 5.5 million tonne.

How far do you think the demand from automobile and construction industry will move towards specialty steel?

The automobile sector utilises specialty steel in large quantities especially coated/plated steel products, high strength steel, alloy steel products of different varieties. However, most of these are imported due to reasons of quality, price competitiveness and OEM (original equipment manufacturer) certifications. It is expected that the PLI scheme for specialty steel will address these issues.

As far as the construction industry is concerned, high strength/wear resistant steel is used in large quantities in the western countries where prefabricated construction has already gained momentum. With the construction industry in India also moving towards prefab structures, we expect the demand of specialty steel to grow which can be met domestically once the PLI scheme takes off.

Union minister Nitin Gadkari has called for reduction in steel prices. There was about 15 per cent increase in domestic price in FY21 over FY18. What are your views on it?

The private sector contributes 86 per cent in steel production and the public sector 14 per cent. When you go in for reforms and open up the economy, it cannot be half way. Increase in the price of steel does impact other sectors. But steel is a deregulated sector where prices depend on a lot of factors. These include demand and supply, global market conditions, trends in price of raw materials, logistics cost, power and fuel cost etc. I am seized of the matter and will certainly look into it.

The government has taken several steps to ensure availability of steel to end users at reasonable prices. For this, efforts were made to ensure ramping up production of iron ore and steel to increase their domestic availability so as to bridge the demand-supply mismatch which would result in softening the steel prices. Further, several tariff measures have been announced in the Budget 2021-22 to ensure reduction in steel prices. These include custom duty reduction, and temporary revocation of anti-dumping duties and countervailing duties on certain products to improve supply in the domestic market.

Integrated steel business has five major players after the sale of companies under IBC. Do you think such consolidation is good for the sector?

There should be competition because if you do not have that there will be degeneration. The fact remains that all decisions regarding mergers and acquisitions, consolidation etc. are taken by the companies keeping in mind their business interests. Consolidation is a market phenomenon. It leads to economies of scale, better synergies, technology transfer, expertise sharing, financial strength and optimization of production and marketing. Acquisition of NPA companies by the large steel players have ensured their recovery which is in the interest of all stakeholders. As a country, we need to focus on the fact that steel production leads to job creation. Also, there is value addition. The role of secondary steel and MSMEs is very important.

What is the status of disinvestment of RINL, Durgapur Steel Plant and Salem Steel Plant?

The process of strategic disinvestment of RINL is in the initial stage and that of Salem Steel Plant is in an advanced stage. There is no proposal for strategic disinvestment of Durgapur Steel Plant as of now. We need to ensure the government institution should be efficient and modernized and have competitive production and there cannot be protection at this stage. We have to be careful and mindful of how we become more efficient and competitive so that they can compete.

What has been the progress on the steel scrapping policy, which was announced in 2019?

The policy announced in 2019 provides a framework to facilitate and promote establishment of metal scrapping centers in a scientific and environmentally friendly way. This in conjunction with the end of life vehicle policy which is being formulated by the ministry of road transport and highways will certainly enhance the availability and utilisation of scrap in the market and will give further strength to the steel scrap recycling.