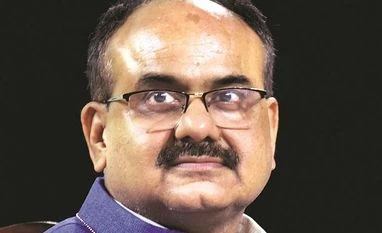

Speaking at a webinar on ‘Transparent Taxation: India's Tax system becomes fearless, painless and seamless’, the finance secretary said that the tax system was going to be entirely data-driven and seamless tax reforms would change the way taxes are paid in the country.

The objective of this reform is to remove the harassment and corruption that people used to criticise earlier, he said.

The coronavirus (Covid-19) pandemic led to better digital adoption and speeded up the implementation of a faceless system in tax administration and the new system removes the territorial system from tax administration and the structure that was inherited from the British, he said.

Pandey said major cases of withdrawal, transactions, stock transaction, foreign travel etc, would be fed into the system. "While they will form the basis for tax assessment -- the selection of cases for assessment will be done electronically," he said.

He further mentioned that out of 70 million I-T return filings as of now, only about 200,000 assesses were being selected for further scrutiny, which clearly showed the government's trust on taxpayers.

"We are obtaining data from not only national transactions but also from 98 countries with whom we have tax treaties," said Pandey.

)