Over 60% Indians ready to invest over $100 mn in distressed assets: Survey

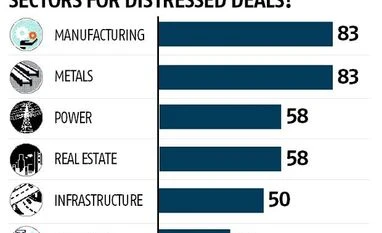

In sectoral terms, over 80% showed preference for metals, chemicals, pharma, cement and discrete manufacturing

)

premium

graph

Just how do equity funds, asset reconstruction companies and strategic investors view the distressed assets market in the country?