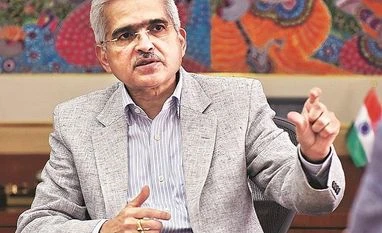

“We are today at the doorstep of the revival process following the Covid crisis. We have told banks and NBFCs that as soon as the crisis settles, they must do stress tests,” Das said at a panel discussion during the launch of 15th Finance Commission Chairman N K Singh’s book, Portraits of Power: Half a Century of Being at Ringside.

“I have appealed and impressed upon them to proactively build capital buffers, not only to strengthen their inherent resilience, but also to have adequate capital to ensure that the credit flow is maintained in a phase when the economy comes for a revival,” Das said. Many of these banks and NBFCs have already raised capital, and many others are planning to do so in the coming months.

The RBI governor stressed the need for governance reforms in banks and NBFCs, and said it should not be mixed with ownership only. “When we talk of reforms in banking, people mix it up with ownership reforms. Governance reforms in banks and NBFCs are ownership neutral,” he said, adding that after the global financial crisis, governance in banks and NBFCs have become an important area of action globally.

“Banks that have robust financial practices, internal practices, and those who don’t undertake smart accounting practices, they survive and grow in every crisis. Governance reforms are ownership agnostic,” Das said.

After the Covid crisis is over, the government "certainly will have to roll out a fiscal roadmap” to ensure it gets back to the debt-to-GDP path that the 15th Finance Commission has set in, Das said. At the moment, though, both fiscal and monetary policies are countercyclical and the general government debt is exceeding the targets earmarked, which would need to be rolled back, he said.

Still, the measures taken by the government have been fiscally prudent and helped sustain the financial sector, according to Das. The RBI, on its part, is in a monetary expansion mode, and has deployed several tools that were earlier not in the toolkit of the RBI.

Participating in the discussion, External Affairs Minister S Jaishankar said multilateralism is in serious danger now, as every country, especially the bigger ones, are “really very much focused on their own interests". But to preserve multilaterals, others need to step forward. There is diversity in the world and differing opinions, and democratising multilateralism can ensure its survival, he said.

India is keenly watching the debates around the US polls on trades, immigration, security issues, and how the most powerful nation views others to gauge the possible impact on the economic, political and cultural rebalancing, Jaishankar said.

Former US Treasury Secretary Lawrence Summers, also in the panel, said he expects a new administration in the US, and that "Covid should bring mankind together not pull apart, and the same can be said about the climate change issue.”

)