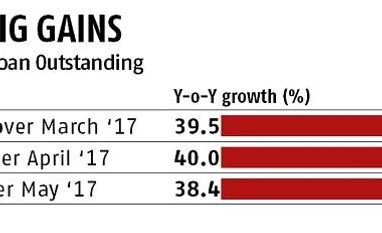

Microcredit witnesses 40% year-on-year growth for the last few months

According RBI data, at the end of May, 2018, the loan outstanding in microcredit segment was close to Rs 197 bn, against Rs 142 bn in May, 2017, representing a growth of about 38%

)

premium

Last Updated : Jul 31 2018 | 1:40 PM IST

Outpacing the overall credit growth, microcredit has been witnessing 40 per cent year-on-year growth for the last few months. Much of the growth is being funded by private institutions, according to industry experts.

While banks, both private and public sector ones, themselves are chasing microfinance borrowers for direct loans (apart from indirect loans by on-lending to MFIs) due to low delinquency rates, in the last few months, several non-banking finance companies have also increased lending to MFIs. For most MFIs, debt account for majority of their fund requirement.

According to the data from Reserve Bank of India (RBI), at the end of May, 2018, the loan outstanding in microcredit segment was close to Rs 197 billion, against Rs 142 billion in May, 2017, representing a growth of about 38 per cent. Against this, the gross bank credit growth in the industry in the same period has been around 11 per cent.

“There has been a larger interest among NBFCs to fund MFIs, although PSBs are still reluctant to lend. At present, about 30-35 per cent of our fund requirement are met by NBFCs,” according to H P Singh, chairman and managing director, Satincare Creditcare Network.

MFIs logged a nearly 40 per cent rise in equity investments during the last financial year. However, debt funding by banks, which registered around 20 per cent growth, remained confined to a top few MFIs last year. Data from Microfinance Institution Network (MFIN) shows that total equity funding for MFIs stood at Rs 96.31 billion in 2017-18 against Rs 68.85 billion in 2016-17. This is a substantial rise of 39.88 per cent.

“MFIs have proven to be the most efficient way to go deeper into geographies to deliver credit to the last mile. MFI grow mainly by adding new customers and by increasing the ticket sizes. Heat maps done by us on MFI penetration using scrub data show that MFIs are moving into white spaces adding new customers. They are also holding on to existing customers by increasing the ticket sizes based on their loans cycles and track record. Back of the envelope calculations seem to show a 15-20 percent growth rate purely basis renewals. Remaining would contributed by new customers,” said Kshama Fernandes, CEO & MD, Northern Arc Capital.

“MFIs have proven to be the most efficient way to go deeper into geographies to deliver credit to the last mile. MFI grow mainly by adding new customers and by increasing the ticket sizes. Heat maps done by us on MFI penetration using scrub data show that MFIs are moving into white spaces adding new customers. They are also holding on to existing customers by increasing the ticket sizes based on their loans cycles and track record. Back of the envelope calculations seem to show a 15-20 percent growth rate purely basis renewals. Remaining would contributed by new customers,” said Kshama Fernandes, CEO & MD, Northern Arc Capital.

“The MFI sector has seen good growth in equity funding. While public sector banks are not funding much to MFIs, the NBFCs are taking advantage. Also, the growth can also be attributed to the fact that last year, there was hardly any growth in the microfinance sector. Now, most MFIs have cleaned their balance sheets and funds, are flowing in. Also, there has been a lot of foreign fund raising through non-convertible debentures,” according to Rakesh Dubey, former president of MFIN.

Foreign investors accounted for nearly 45 per cent equity funding in MFIs as on March 31, 2018. “Investments are once again coming in the MFI sector, and it is poised to grow in the coming days. Much of the funding is coming from the private sector. While public sector banks only lend to high-rated MFIs, private sector banks, have their own mechanism of due diligence, which takes into account pure profit and performance, apart from credit rating,” according to Ratna Vishwanathan, former CEO, MFIN.

According to Manoj Nambiar, MD, Arohan Financial Services, margins for MFIs have improved as cost of funds have come down.

“After the portfolio clean-up post demonetisation, lenders are comfortable with lending to MFIs, For us, the pricing to end customers has come down to about 20.70 per cent in the last few months,” according to Nambiar.