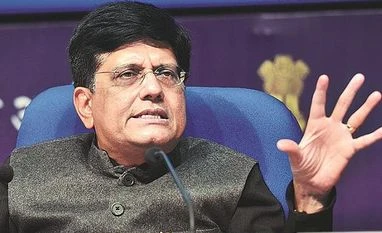

This comes after Union cabinet minister Piyush Goyal’s statement that bankers will meet real estate players in a forthright.

The sector has been hit hard by demonitisation and the Real Estate Regulations (RERA). This is in addition to challenges like delays in project completion, questionable sources of funds and divergence of money and weak project management practices, bankers said.

A few days ago, while addressing a Confederation of Real Estate Developers' Associations of India (CREDAI) event in Delhi, interim finance minister Piyush Goyal had said that within the next 7-15 days, the Indian Banks' Association (IBA) will hold a meeting with the real estate players to help increase funding to the sector.

The minister also assured that goods and services tax (GST) rates would be brought down soon for the sector, which has been facing a demand slack.

“There is a real problem (being faced by the realty sector),” Goyal said.

Public sector bankers dealing in housing finance said the sector is in transition, showing the effects of RERA. Many of the builders have taken huge exposures and inventories (housing units and commercial places) are piling up. The returns are coming down. Some of them are defaulting, which is matter of concern for lenders.

After Reserve Bank India’s (RBI) February 12, 2018, circular on restructuring of stressed loans, which is more stringent, things have become tight. So, there is hesitation to take additional exposure to the already risky sector, pointed out a private banker.

The loans to commercial real estate sector from banks have grown by just 4.1 per cent in 12 months in December 2018. The outstanding loans to commercial real estate stood at Rs 1.9 trillion, according to RBI data.

Rating agency ICRA, in its outlook on the real estate sector, said the residential realty segment has been increasingly relying on non-banking financial companies (NBFCs) and housing finance companies (HFCs) to raise debt financing. This is owing to the risk perception attached with the segment by banks.

The liquidity crunch faced by the NBFC and HFC segment towards the mid of FY2019 has impacted fund availability to the real estate sector. If the current scenario persists in FY2020, it may cause credit stress to developers who are reliant on refinancing to support balance sheets on land assets or slow-moving inventory, ICRA added.

)