Sebi may tighten AIF regulations to better monitor the source of funding

The regulator may also conduct regulatory audits on the AIFs to examine the fund sourcing arrangements with investors to ensure that the present regulations are not violated

)

premium

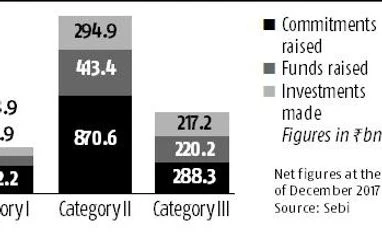

The Securities and Exchange Board of India (Sebi) plans to tighten regulations for Alternative Investment Funds (AIF) to better monitor the source of funding and their end use.

According to sources, Sebi may check anti-money laundering policies implemented by AIFs and examine the sanctity of back-end arrangements that investment vehicles might have with investors. The move is to prevent instances where money raised in AIFs is invested back in entities owned by the investors.

The regulator might also conduct regulatory audits on AIFs to examine fund sourcing arrangements in order to ensure regulations are not violated.

“Sebi might be inclined to monitor the source of funding to ensure the AIF route is not misused, given the wide range of investors from whom the money can be raised and the limited investor base,” said Tejesh Chitlangi, partner, IC Universal Legal.

AIFs can raise money from both domestic and foreign investors. Unlike mutual funds, which can raise overseas money only from foreign portfolio investors (FPIs) and NRIs, AIFs can do so from all classes of overseas investors.

Present AIF regulations contemplate an investment in debt, which has prompted certain funds to extend loans that otherwise cannot be done under the present Sebi and Reserve Bank of India (RBI) norms.

According to sources, Sebi may check anti-money laundering policies implemented by AIFs and examine the sanctity of back-end arrangements that investment vehicles might have with investors. The move is to prevent instances where money raised in AIFs is invested back in entities owned by the investors.

The regulator might also conduct regulatory audits on AIFs to examine fund sourcing arrangements in order to ensure regulations are not violated.

“Sebi might be inclined to monitor the source of funding to ensure the AIF route is not misused, given the wide range of investors from whom the money can be raised and the limited investor base,” said Tejesh Chitlangi, partner, IC Universal Legal.

AIFs can raise money from both domestic and foreign investors. Unlike mutual funds, which can raise overseas money only from foreign portfolio investors (FPIs) and NRIs, AIFs can do so from all classes of overseas investors.

Present AIF regulations contemplate an investment in debt, which has prompted certain funds to extend loans that otherwise cannot be done under the present Sebi and Reserve Bank of India (RBI) norms.