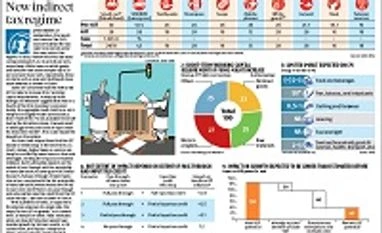

Statsguru: New indirect tax regime

The rates have allayed fears that the GST would be inflationary in the short term

)

premium

(Click on picture for details)

After months of deliberation, the Goods and Services Tax (GST) Council finalised the tax rates to be levied under the new indirect tax regime. As such, there will be four tax slabs corresponding to 5, 12, 18 and 28 per cent, respectively. While taxes on white goods and telecom have been bumped up to 28 per cent and 18 per cent, respectively, those on items such as soap and toothpaste have been lowered as shown in Chart 1.