BoB, Dena, Vijaya Bank to merge; process completion may take 4-6 months

Amalgamated entity to be third-largest lender; govt to continue to provide capital support

)

premium

Last Updated : Sep 18 2018 | 2:08 AM IST

The central government on Monday proposed to create the country’s third-largest bank by amalgamating Mumbai-based Dena Bank and Bengaluru-based Vijaya Bank with much larger Bank of Baroda (BoB) in an all-stock deal. The banks’ boards are expected to meet in 10 days to take a call. The deal, though, is almost a certainty since the government is the majority owner.

“The government had announced in the Budget that consolidating banks was on our agenda and the first step has been announced,” Finance Minister Arun Jaitley said. He justified the action, stating that the government and the Reserve Bank of India (RBI) were forced to take “concrete steps” once the asset quality review of banks revealed the bad debt rot in Indian banks was far deeper than what was projected earlier.

Nine bank unions said they would go on a nationwide demonstration on Tuesday and the course of action will be decided by Wednesday.

Earlier the government merged State Bank of India’s associate banks with the parent, and let Life Insurance Corporation take over bad debt-ridden IDBI Bank. Unions have opposed both the moves.

Before the asset quality review of the central bank, the bad debts declared by banks were Rs 2.5 trillion. After the review, they turned out to be Rs 8.5 trillion, as banks resorted to “restructuring and evergreening of loans”.

Amid the market ignoring the government’s five-point agenda of stabilising the rupee, Jaitley and Financial Services Secretary Rajiv Kumar held a surprise press meet to announce the amalgamation. The finance minister said the Centre was keen on saving banks under prompt corrective action (PCA), possibly by merging them in the same manner. “One of these banks is under PCA and we want to save all such banks,” Jaitley said.

“The capacity to subsume a weaker bank is a principal factor that was weighed in by the government,” the finance minister said, adding the government had consulted the RBI on the matter.

Anjali Bansal, current non-executive chairman of Dena Bank, is likely to be chairman of the merged entity. Bansal is an independent director on the boards of several leading companies and prior to that she was a partner and MD at TPG Global and was founder MD at Spencer Stuart India.

Many, including the bank managements, have supported the choice of the banks being merged. “Of the 21 banks in the system, this is the best combination,” said R A Sankara Narayanan, managing director and chief executive officer of Vijaya Bank.

On the sidelines of the press conference in New Delhi, BoB MD and CEO P S Jayakumar said the merger would take four-six months and the share-swap ratio would be decided soon.

He said the advantage for BoB is that the lending would diversify into retail and micro, small and medium enterprises, taking its loan book size up by 40 per cent. “We would have more branches in states where we are grossly under-represented, such as Andhra Pradesh, Kerala and Karnataka. If you ask me what would be the benefit for Vijaya Bank, BoB brings a huge foreign currency position to the table, technology is there and a lot of things we are doing in our transformational journey which can be of value to them,” Jayakumar said.

ALSO READ: Merger of banks: This is the best combination possible, says Vijaya Bank MD

ALSO READ: Merger of banks: This is the best combination possible, says Vijaya Bank MD

The combined entity, taking their separate March quarter numbers, had assets of Rs 10.19 trillion. The top two lenders — State Bank of India and HDFC Bank — had assets of Rs 34.55 trillion and Rs 10.64 trillion, respectively. The merged entity will be the second-largest public sector bank, trumping Punjab National Bank’s asset base of Rs 7.67 trillion.

Jaitley assured no employee will face any “adverse” service conditions. He said the move was good news for the employees of Dena Bank in particular. “They will probably stand to get conditions better than they have at present,” Jaitley said.

According to V G Kannan, CEO of the Indian Banks’ Association, economies of scale and large players are positives for the banking system. “Three of them have the same core banking platform — Finacle of Infosys. It will make technology integration a smooth process. As for impact on employees, many are going to retire over the next few years. Fresh employee intake may slow in the integrated entity,” Kannan said.

ALSO READ: Merger of banks: Synergy benefit relevant in Gujarat, says Dena Bank Executive Director

ALSO READ: Merger of banks: Synergy benefit relevant in Gujarat, says Dena Bank Executive Director

It is beneficial for the system to get larger banks but the integration will have to be “managed well to gain business benefits”, said Karthik Srinivasan, group head of financial sector ratings at ICRA.

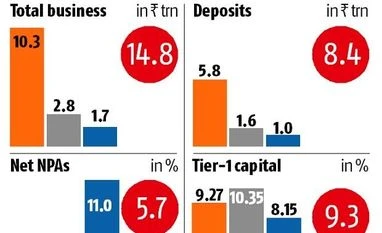

Among the three, Dena Bank is a laggard. It is under RBI’s PCA framework and has a net non-performing asset (NPA) ratio of 11.04 per cent. High bad debts have eroded the capital base of the bank, with the core equity ratio (CET1) at 8.15 per cent of the risk-weighted assets. Vijaya Bank is one of the best performers among public sector banks, having a net NPA ratio of 4.10 per cent, and a CET1 of 10.35 per cent. BoB, the much larger bank, has a steady profile, a net NPA ratio at 5.40 per cent and CET1 at 9.27 per cent. The combined entity will have net NPA ratio of 5.71 per cent, and CET1 of 9.32 per cent.

ALSO READ: Staff need not worry about redundancies after merger of banks: BoB chief

ALSO READ: Staff need not worry about redundancies after merger of banks: BoB chief

The merger proposal will first need to be approved by the board of directors of the three banks. The government will then prepare an amalgamation scheme, which will need to be approved by the cabinet of ministers and the houses of parliament.

The Financial Services Secretary said: “It will be a strong competitive bank with economies of scale, network synergies, low-cost deposits and subsidiaries, and a possibility of greater outreach and expansion.”

Banking sector reforms are a major plank of Prime Minister Narendra Modi's administration to revive credit growth, which has slowed to multi-decade lows. The government owns majority stakes in 21 lenders, which account for more than two-thirds of banking assets in Asia's third-biggest economy. But these banks also account for the lion's share of more than $150 billion in sour assets plaguing the sector, and need billions of dollars in new capital in the next two years to meet global Basel III capital norms.