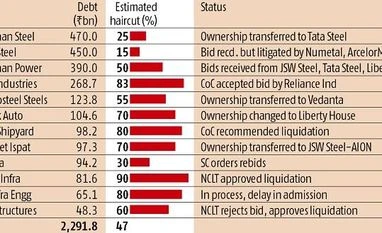

Debt resolution under IBC process: Banks take 47% haircut in RBI first list

Lack of capacity at the NCLTs is turning out to be a big concern for the investors as well as lenders

)

premium

With debt resolution under the Insolvency and Bankruptcy Code process picking up, banks have seen Rs 550 billion of recoveries at an average 47% haircut in the Reserve Bank of India’s (RBI) first list announced in June 2017. The pick-up in recoveries to 4% of loans in June quarter was also primarily on account of IBC-led resolutions. According to Credit Suisse, though the IBC process is time-bound (180 days extendable to 270 days), many of the larger cases have witnessed delays.