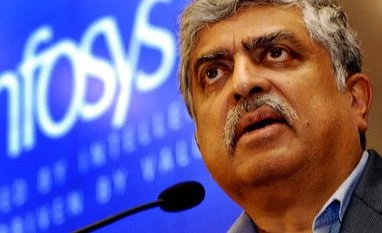

Loans will be disbursed based on data, says Nandan Nilekani

Nilekani said the data available in the GST system could be the basis of credit.

)

premium

Non-Executive Chairman, Infosys Nandan Nilekani addresses a press conference at Infosys campus in Bengaluru. BS photo by Saggere Radhakrishna

Nandan Nilekani on Wednesday said India was moving in a direction where lenders will use data such as the goods and services tax (GST)-based “business flows” or credit payment history, instead of collaterals to provide loans to businesses and consumers.