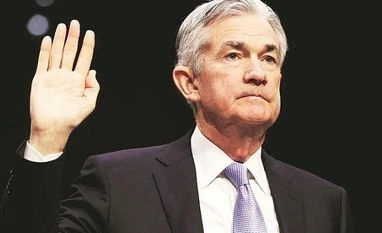

“Generally speaking I think the financial system is quite strong,” Powell said in his confirmation hearing. Asked if there are any US banks that are still too big to fail in America, he responded, “I would say no to that.”

The collapse of US investment bank Lehman Brothers in 2008 sparked chaos across the global financial system giving rise to the concept of ‘too big to fail’ institutions. Following Lehman’s demise, governments across the world spent more than $1 trillion bailing out wobbly financial firms fearing economic disaster if they failed to act. Since then, regulators have introduced a slew of measures, including increased capital buffers, liquidity requirements, safeguards for trading derivatives and the creation of so-called ‘living wills’ that have helped make individual banks — and the broader financial system — safer.

Critically, banks have spent several years and millions of dollars drawing up living wills which outline how a global US-headquartered bank — such as Citi, Morgan Stanley or JPMorgan — could be safely wound down if they fall into trouble. Privately, some regulators and experts who helped draw up the living wills have told Reuters they do not believe the too-big-to-fail problem has been resolved and that these plans may not be successful when ultimately tested during a crisis.

On Tuesday, Powell — who was nominated by Republican President Donald Trump this month to replace current Fed chair Janet Yellen — said that although these measures had fixed too-big-to-fail, big financial firms still needed a special bankruptcy regime. The 2010 Dodd Frank law creates a special liquidation regime for financial firms because the traditional bankruptcy process is not considered sophisticated enough for large complex financial firms. This special regime, known as the ‘Orderly Liquidation Authority’ has been under attack by Republicans but Powell said it may still be necessary in extraordinary circumstances.

)