Snap's $2.2-billion loss caps bumpy Q1

Yet just 2 months into its life as a public company, Snap's celebration may already be ending

)

premium

When Snap listed its shares on the New York Stock Exchange in March, the floor of the exchange was festooned in the company’s signature yellow. Family members of Snap executives posed for photographs; some wore the company’s video-recording Spectacles. And as Snap’s two 20-something founders rang the opening bell, the crowd — including one of the founder’s fathers and a supermodel fiancée — applauded.

Yet just two months into its life as a public company, Snap’s celebration may already be ending.

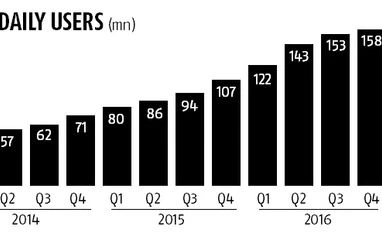

On Wednesday, Snap, the parent of the messaging app Snapchat, reported earnings that missed Wall Street expectations in almost every regard. Not only did Snap record a $2.2 billion loss for the first quarter, its revenue was lighter than expected, and the company disclosed that its user growth was decelerating sharply. Investors punished the company, sending its stock down more than 25 per cent in after-hours trading.

The results represented a bumpy start for Snap after its much-celebrated initial public offering, the biggest for a technology company in recent years. Snap’s earnings illustrate how difficult it is for smaller social media companies to compete in the age of Facebook, the social network run by Mark Zuckerberg, which has sucked up more than two billion people worldwide and has made the size of its network a primary selling point.

For Snap, the challenge is tricky because the company approaches social networking differently. Instead of emphasising the number of people users know, Snapchat focuses on fewer connections and the quality of friends on the network. Yet with Wall Street and others using Facebook as a benchmark, the comparisons for Snap are tough. For now, Snap looks more like Twitter, the social media service that has had rough times because of anemic user growth.

Yet just two months into its life as a public company, Snap’s celebration may already be ending.

On Wednesday, Snap, the parent of the messaging app Snapchat, reported earnings that missed Wall Street expectations in almost every regard. Not only did Snap record a $2.2 billion loss for the first quarter, its revenue was lighter than expected, and the company disclosed that its user growth was decelerating sharply. Investors punished the company, sending its stock down more than 25 per cent in after-hours trading.

The results represented a bumpy start for Snap after its much-celebrated initial public offering, the biggest for a technology company in recent years. Snap’s earnings illustrate how difficult it is for smaller social media companies to compete in the age of Facebook, the social network run by Mark Zuckerberg, which has sucked up more than two billion people worldwide and has made the size of its network a primary selling point.

For Snap, the challenge is tricky because the company approaches social networking differently. Instead of emphasising the number of people users know, Snapchat focuses on fewer connections and the quality of friends on the network. Yet with Wall Street and others using Facebook as a benchmark, the comparisons for Snap are tough. For now, Snap looks more like Twitter, the social media service that has had rough times because of anemic user growth.