Commodity outlook by Tradebulls Securities: Sell copper, nickel

Commodity outlook and trading ideas by Bhavik Patel - Sr. Technical Analyst (Commodities), Tradebulls.

)

premium

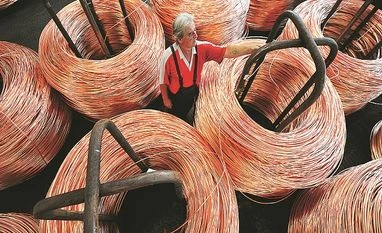

Copper

Gold is witnessing some normal, healthy, corrective consolidation after prices on July 19 soared to six-year high. Until July, 31st (US Fed meeting), we expect gold prices to oscillate between $1440-$1400 and would move according to the US data. Traders and investors' main focus would be on European Central Bank (ECB) and the US Fed. We might see some correction in gold and then a pull back after the ECB hinted at an additional accommodative policy which has made EURO weaker and Dollar stronger and by extension Gold weaker. But any accommodative policy is positive for metal so we may see rally later on in gold.

Silver speculators sharply boosted their bullish bets after 2 dull weeks. We continue to prefer silver against gold currently as silver has still catching up to do. Since the past 4-5 trading sessions, silver is outperforming gold and any dips have been bought into. We expect the trend to continue till end of this month. Silver bulls next upside target would be to break levels of $17 while next support is seen at $16. Silver’s rally may come under threat if bears can extend decline below $15.835.

Silver speculators sharply boosted their bullish bets after 2 dull weeks. We continue to prefer silver against gold currently as silver has still catching up to do. Since the past 4-5 trading sessions, silver is outperforming gold and any dips have been bought into. We expect the trend to continue till end of this month. Silver bulls next upside target would be to break levels of $17 while next support is seen at $16. Silver’s rally may come under threat if bears can extend decline below $15.835.