Cool stocks to beat the sizzling heat this summer

Even as Johnson Controls-Hitachi, Voltas, Blue Star, Whirlpool recently recorded new 52-week highs

)

premium

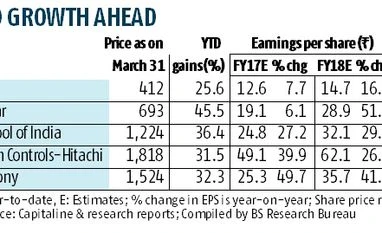

The past week belonged to consumer durables stocks such as Voltas, Blue Star, Whirlpool of India, Johnson Controls-Hitachi Air Conditioning India and Symphony. These are trading at their all-time highs, and the Street is convinced that there’s more steam left in the rally.

These stocks started gathering momentum in late February, when it became apparent that demonetisation hiccups were perhaps well behind them. But, what has propelled the rally is the onset of summer and, more importantly, the high probability of an extended summer.

The recent shift in preference among institutional investors from consumer staples to durables also augurs well for these stocks. The first on the list is Blue Star, which has seen an all-round improvement in business. Even in a tough December quarter, its room AC business grew 47 per cent, outpacing the 25 per cent industry growth. Ability to constantly improve its market share in this segment, from 10 per cent a year-ago to 11.5 per cent now, is another positive. A gradual recovery is also expected in its projects business, thanks to rising enquiries from hospitals and educational institutions. Operating margins may, however, be under pressure in the next six months, given the promotional activities undertaken for relatively newer launches, such as water and air purifiers and air coolers.

Investors can consider one of the two multinationals in this list—Johnson Controls-Hitachi Air Conditioning. Shift in preference from normal ACs to inverter ACs strengthens the investment pitch for Hitachi. It is among the innovators of inverter ACs. The June quarter tends to be the best for the company, with operating margins of over 11 per cent (best in the industry). But, the momentum cools off in the October and December quarters, when the demand for ACs tapers, and picks up again in the January quarter. However, Hitachi is strengthening its exports and projects business to offset this cyclicality in the business.

These stocks started gathering momentum in late February, when it became apparent that demonetisation hiccups were perhaps well behind them. But, what has propelled the rally is the onset of summer and, more importantly, the high probability of an extended summer.

The recent shift in preference among institutional investors from consumer staples to durables also augurs well for these stocks. The first on the list is Blue Star, which has seen an all-round improvement in business. Even in a tough December quarter, its room AC business grew 47 per cent, outpacing the 25 per cent industry growth. Ability to constantly improve its market share in this segment, from 10 per cent a year-ago to 11.5 per cent now, is another positive. A gradual recovery is also expected in its projects business, thanks to rising enquiries from hospitals and educational institutions. Operating margins may, however, be under pressure in the next six months, given the promotional activities undertaken for relatively newer launches, such as water and air purifiers and air coolers.

Investors can consider one of the two multinationals in this list—Johnson Controls-Hitachi Air Conditioning. Shift in preference from normal ACs to inverter ACs strengthens the investment pitch for Hitachi. It is among the innovators of inverter ACs. The June quarter tends to be the best for the company, with operating margins of over 11 per cent (best in the industry). But, the momentum cools off in the October and December quarters, when the demand for ACs tapers, and picks up again in the January quarter. However, Hitachi is strengthening its exports and projects business to offset this cyclicality in the business.