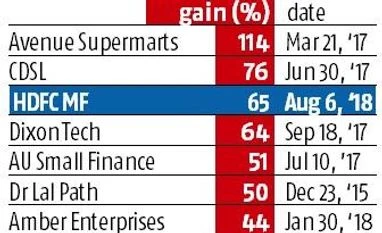

On impressive trading debut, shares of HDFC Mutual Fund surge 65%

Asset manager adds Rs 152 bn in market value in best listing since last year's D-Mart

)

premium

Shares of HDFC Mutual Fund surged 68 per cent during their trading debut on Monday, in what was the best listing-day performance since Avenue Supermarts last year for an IPO of more than Rs 10 billion. Shares of the asset manager ended at Rs 1,815, up Rs 715 or 65 per cent, over the issue price of Rs 1,100 per share. Avenue Supermarts’ shares had more than doubled on their trading debut in March 2017. The stock of the D-Mart retail chain operator is currently up 5.5 times over their issue price.