ICEX to launch diamond futures soon

Last week received in-principle permission to restart exchange, trading expected from March

)

premium

Image

Last Updated : Jan 10 2017 | 2:01 AM IST

After suspending trading for three years, the Indian Commodity Exchange (ICEX), anchored by Reliance Capital, is launching the world's first exchange-traded diamond futures, which will be settled by delivery.

The Securities and Exchange Board of India (Sebi) last week gave in-principle approval to the exchange to resume operations with the launch of derivatives trading and the first contract approved was of diamond.

This is also Sebi's first approval of trading in commodity derivatives after taking over the regulation of commodities trading.

The contracts will be monthly, with diamond quality specifications and the stipulation that it must be mined by a Kimberly-approved diamond mine including those owned by De Beers, Alrosa, Argyle and Rio Tinto. The delivery centre will be Surat, and the International Institute of Diamond Grading and Research (IIDGR), which is part of the DE Beers group and has a branch in Surat, will do quality testing and grading before the diamonds are delivered on the exchange.

Sanjit Prasad, managing director and chief executive officer, ICEX, said: "Though Indians are the largest processors of diamonds globally, we don't have the power of pricing. Today diamond pricing is opaque and skewed. With diamond futures contracts, the ICEX will empower diamond manufacturers in India to be a 'price maker' rather than a 'price taker'."

Trading is expected to start in March, and the exchange plans to launch three contracts — 30 cents, 50 cents, and 1 carat — as part of its strategy.

Three monthly contracts are expected to be launched for trading, to begin by the fifth day of each month. The deals will have to be squared off or carried forward to the next contract at the end of the month before the delivery period begins in the next month between the first and the fifth day.

Image

According to executives in the diamond industry, price discovery will happen based on the Rapaport (a diamond-manufacturing group) price, considered the benchmark.

Sightholders (a Sightholder is a company on the De Beers Global Sightholder Sales’s list of authorised bulk purchasers of rough diamonds) will sell on the exchange and processors will buy the product and these deals can be hedging in nature or for delivery also. Brokers will do the market making and 37 members have been approved by Sebi. And 30 more applications for registering as member on the ICEX are with the regulator.

Sightholders (a Sightholder is a company on the De Beers Global Sightholder Sales’s list of authorised bulk purchasers of rough diamonds) will sell on the exchange and processors will buy the product and these deals can be hedging in nature or for delivery also. Brokers will do the market making and 37 members have been approved by Sebi. And 30 more applications for registering as member on the ICEX are with the regulator.

The membership fee, according to an exchange official, is Rs 7.5 lakh for trading members and Rs 10 lakh for trading-cum-clearing members.

Several commodity market members have also taken membership of the exchange along with diamond market players including Sightholders.

At present the price of the benchmark variety which will be traded on the exchange is Rs 3.5 lakh per carat, with a minimum trading of one hundredth of a carat or one cent, which will allow small investors to participate and invest in diamonds. Investors can hold diamonds in electronic form.

Since the delivery will be in electronic form and repository will be maintained by the exchange’s clearing house, investors’ accounts will be credited or debited for even one cent of diamond. However, delivery will be a minimum of one carat.

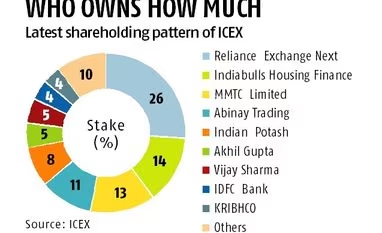

Exchange officials said at present their net worth was Rs 50 crore and soon they will come out with a probable another rights issue of Rs 50 crore, which will take their net worth to the required level of Rs 100 crore.