The panic was triggered by developments at the country's largest TV network, Zee, where a sharp fall in shares of the group companies, coupled with high promoter pledging, put lenders, especially mutual funds, in a spot.

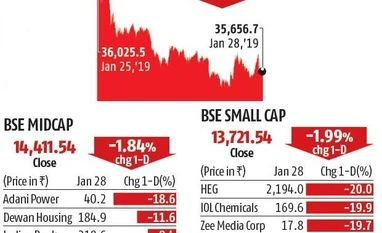

While shares of Zee rebounded on Monday, following an agreement with lenders, investors started dumping firms where debt levels and promoter pledging was high. The benchmark Sensex fell 369 points, or 1.02 per cent, to close at a three-week low of 35,657. The Nifty fell 1.1 per cent, or 119 points, to end at 10,661. The Nifty Midcap 100 and Smallcap 100 indices fell around 2 per cent each.

The shares of Adani Ports, Adani Power, Jindal Stainless, Reliance Capital, and Suzlon saw heavy selling. Adani Ports and Adani Power fell as much as 20 per cent in intra-day trade. Most of these companies have high debt and a substantial portion of their promoter shares are pledged with lenders. Banking and financial stocks also witnessed a sharp sell-off on fears of default and contagion risks. The shares of DHFL fell 12 per cent, YES Bank fell 5.5 per cent and ICICI Bank declined 3.8 per cent.

“The latest developments in the Essel Group have led to nervousness. The mood in the markets is to stay away from companies where the promoter has a lot of borrowings against the shares. The fear is that these companies are in a vulnerable position,” said U R Bhat, managing director at Dalton Capital.

Experts said the latest events resurfaced fears of the IL&FS episode, with risks getting spilled over to the overall market. “The market is worried about the implications on liquidity. These things have damaging effect on sentiment. The uncertainty, which the market had overcome, has now come back again. There will be rumours of who has pledged shares. All these will keep the markets volatile,” said Andrew Holland, chief executive officer at Avendus Capital Public Markets Alternate Strategies.

The India VIX index, a gauge for market volatility, rose 7 per cent to 18.9. All 19 sectoral indices of the BSE, with the exception of two, ended with losses. There were nearly four falling stocks for every one advancing stock on the BSE. Experts said volatility in individual stocks, ahead of the January series derivatives’ expiry on Thursday, would be high. Investors were cautious ahead of the Budget and corporate earnings announcement. Market players will be eyeing if the Centre is able to meet the fiscal deficit target for this fiscal year and the next.

)