Sensex crosses 30,000: Markets scale new peak on monsoon forecast

Nifty closes at 9,407, Sensex at 30,248

)

premium

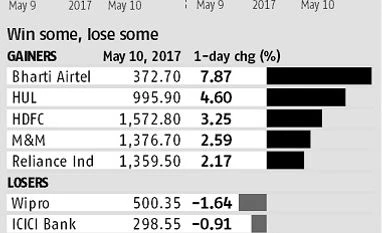

Equities continue to scale new peaks, defying warnings by many market pundits of a possible consolidation. The S&P BSE Sensex on Wednesday gained 315 points, or 1.05 per cent, to close at 30,248, and the Nifty breached 9,400 for the first time to close at 9,407.3,

90.4 points, or 1 per cent, higher than its previous closing. The broader markets witnessed a similar trend with the mid- and small-cap indices rallying 0.87 per cent and 0.75 per cent, respectively.

Since the Sensex touched 30,000 intra-day on April 5, many experts have been warning that a market correction, or at least a consolidation (time correction), could be underway.

The current rally has been driven by aggressive buying by mutual funds and insurance companies. Since April 1, domestic institutions have purchased equities worth Rs 11,575 crore while foreign portfolio investors (FPIs) trimmed their exposure to the Indian market by nearly Rs 4,000 crore.

“The benchmark indices today touched new lifetime highs as the market continues to cheer a favourable set of developments such as a normal monsoon, benign crude oil prices and a decent set of fourth-quarter earnings,” said Pankaj Pandey, head of research at ICICI Direct.

90.4 points, or 1 per cent, higher than its previous closing. The broader markets witnessed a similar trend with the mid- and small-cap indices rallying 0.87 per cent and 0.75 per cent, respectively.

Since the Sensex touched 30,000 intra-day on April 5, many experts have been warning that a market correction, or at least a consolidation (time correction), could be underway.

The current rally has been driven by aggressive buying by mutual funds and insurance companies. Since April 1, domestic institutions have purchased equities worth Rs 11,575 crore while foreign portfolio investors (FPIs) trimmed their exposure to the Indian market by nearly Rs 4,000 crore.

“The benchmark indices today touched new lifetime highs as the market continues to cheer a favourable set of developments such as a normal monsoon, benign crude oil prices and a decent set of fourth-quarter earnings,” said Pankaj Pandey, head of research at ICICI Direct.