Here's why the central bank opted for a 35 bps rate cut and other top highlights from the latest RBI policy meet -

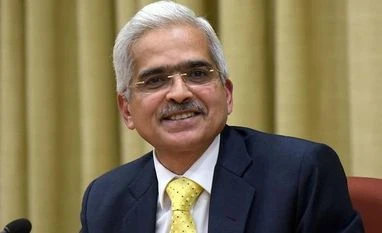

Quantum of rate cut a balanced call: In view of the current macro-economic condition assessed by the MPC members, a 25 bps rate cut would have been inadequate while a 50 bps cut would have been excessive, especially after taking into accounts actions already taken by RBI. Hence, a 35 bps rate cut was seen as a balanced call for now, explained RBI Governor Shaktikanta Das in a presser post policy announcement.

"The 35 bps rate cut should be seen as a signal that the RBI MPC is quite concerned with the growth outlook beyond the usual 25 bps rate cut in a business-as-usual scenario (even though it does not reflect in the revised FY2020 GDP growth estimate). The RBI MPC did not necessarily want to deliver a 50 bps rate cut and hence, retains the scope to reduce rates further," said Suvodeep Rakshit, Senior Economist at Kotak Institutional Equities.

"With inflation expected to remain benign, and further downside to growth outlook, we see scope for 25-50 bps of further rate cuts through FY2020," Rakshit added.

FY20 growth forecast lowered: Various high frequency indicators, the RBI said, suggested weakening of domestic and external demand conditions. This led the committee to lower GDP growth forecast for the financial year 2019-20 (FY20) to 6.9 per cent from 7 per cent, earlier. It observed that services sector activity for May-June present a mixed picture, while tractor and motorcycle sales – indicators of rural demand – continued to contract. Among indicators of urban demand, passenger vehicle sales contracted for the eighth consecutive month in June; however, domestic air passenger traffic growth turned positive in June after three consecutive months of contraction.

Global economy slows down: The MPC noted that global economic activity has slowed since the meeting of the MPC in June 2019, amidst elevated trade tensions and geo-political uncertainty. “GDP growth in the US decelerated in Q2:2019 while in the Euro area, too, GDP growth moderated during the period on worsening external conditions. Economic activity in the UK also continues to be subdued owing to Brexit-related uncertainty,” the RBI said.

Inflation outlook: The committee projected the CPI inflation at 3.1 per cent for the second quarter of the financial year 2019-20 (FY20) and 3.5-3.7 per cent for the second half of the fiscal year (H22019-20), with risks evenly balanced. CPI inflation for Q1 of 2020-21 is projected at 3.6 per cent.

Accommodative stance retained: The MPC also decided to maintain the accommodative stance of monetary policy. The stance means rate increase is off the table. In its June policy meet, the RBI had changed the stance to accommodative to neutral.

Liquidity concerns assuaged: The RBI, in its policy statement, noted that liquidity in the system was in large surplus in June-July 2019 due to factors such as return of currency to the banking system, reduction of excess cash reserve ratio (CRR) balances by banks, open market operation (OMO) purchase auctions, and the RBI’s foreign exchange market operations.

Transmission of rate cuts: The transmission of policy repo rate cuts on fresh rupee loans of banks has improved marginally since the last meeting of the MPC. Overall, banks reduced their WALR (weighted average lending rates) on fresh rupee loans by 29 bps during the current easing phase so far (February-June 2019), the statement added.

)