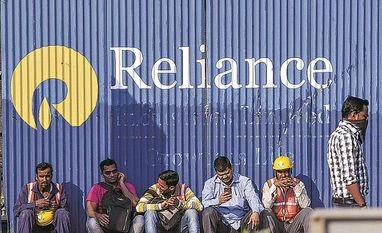

A new Reliance

The focus on consumer-facing businesses has come at a cost

)

premium

Reliance Industries Ltd (RIL) is going through an interesting transformation, with the new businesses of telecom and retail accounting for a quarter of the company’s consolidated revenue. If other businesses such as media are included, the energy business would be a little under 70 per cent. The numbers of the new businesses are not small — retail and Jio brought Rs 1.77 trillion in revenue in FY19. Jio caused a disruption in the telecom market and became the third-largest telco with 300 million subscribers at the end of March 2019. Five years ago, retail, despite being the country’s largest, was subsumed under “others”, and accounted for under 5 per cent of revenue, and telecom hadn’t even started. For the shareholder, it has been a profitable journey — the RIL stock is up 170 per cent since Jio’s launch in September 2016. RIL’s move stems from diversifying against the cyclical nature of the oil business and deploying the huge cash that the business generates in good times. The stock traded in a relatively narrow range for nearly a decade till 2017 barring a swing to a high and a low in 2008. Beyond the new capacities in refining and petchem, there was a need to deploy funds. But the diversifications into oil and gas exploration and shale gas, both related to its core business, were not yielding dividends, leading the company to focus on retail and telecom. RIL now has more aces up its sleeve as it seeks to integrate communication, content and commerce.