Crowding out and opening up

Tied spending, revenue crunch mean the finance minister did the best she could on financing the deficit

)

premium

Finance Minister Nirmala Sitharaman prepared the Union Budget for 2020-21 while labouring under multiple constraints. The economy has slowed sharply. Tax revenue is lower than expected by perhaps 0.7 per cent of gross domestic product or GDP — though what proportion of this is due to the economic slowdown and what to problems with goods and services tax (GST) cannot easily be determined. Political constraints continue to operate on the Budget process, given that this government is in perpetual election fighting mode, and the prime minister’s office is known to be exceptionally active. While Ms Sitharaman has demonstrated that she has little time for interest groups demanding special or sectoral benefits, it is also true that even experts are divided on what is the best response at this time — to ignore fiscal constraints in order to stimulate demand for the short run, or to continue to exercise restraint while pushing forward structural reform using this moment of crisis.

In the end, the FM appears to have chosen, as most in her position before her have, to attempt to find a via media between these two approaches. The fiscal glide path was altered — on paper — only as much as the Fiscal Responsibility and Budget Management Act allows, while spending was controlled, but not to the degree that might be warranted, given the crunch in revenue. In some sense, any such Budget will be seen by both sides of the debate as a “disappointment”.

Certainly, the equity markets, which were open and trading on Budget Day although it was a Saturday, seem to have reflected such a disappointment. Some must have hoped that a big fiscal stimulus was in the works that would have “revived” consumer demand and perhaps spilled over into corporate earnings. I am uncertain, however, about the thought processes that underlay this expectation. After all, many people also believe that tax evasion has been widespread under the new GST system. If GST is underperforming by as much as a percentage point of GDP thanks to evasion, what does that mean? Certainly, if the tax to GDP ratio has declined since 2017-18, partly due to indirect taxes remaining in the hands of the population, does that not count as a stimulus of equivalent size?

In the end, the FM appears to have chosen, as most in her position before her have, to attempt to find a via media between these two approaches. The fiscal glide path was altered — on paper — only as much as the Fiscal Responsibility and Budget Management Act allows, while spending was controlled, but not to the degree that might be warranted, given the crunch in revenue. In some sense, any such Budget will be seen by both sides of the debate as a “disappointment”.

Certainly, the equity markets, which were open and trading on Budget Day although it was a Saturday, seem to have reflected such a disappointment. Some must have hoped that a big fiscal stimulus was in the works that would have “revived” consumer demand and perhaps spilled over into corporate earnings. I am uncertain, however, about the thought processes that underlay this expectation. After all, many people also believe that tax evasion has been widespread under the new GST system. If GST is underperforming by as much as a percentage point of GDP thanks to evasion, what does that mean? Certainly, if the tax to GDP ratio has declined since 2017-18, partly due to indirect taxes remaining in the hands of the population, does that not count as a stimulus of equivalent size?

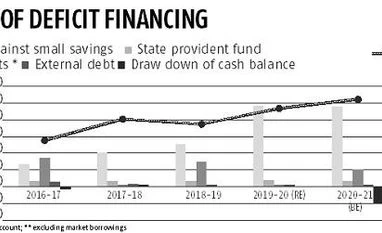

There are legitimate questions that might be asked whether the fiscal deficit has indeed been contained and will be contained to the headline levels. The FM has been far more transparent than has been the practice in recent years, by making some extra-Budgetary borrowing explicit, and showing how much that pushes up the actual fiscal deficit. However, the fact remains that some other borrowing by quasi-government agencies is not reflected here.

Disclaimer: These are personal views of the writer. They do not necessarily reflect the opinion of www.business-standard.com or the Business Standard newspaper