High and dry in the IBC era

The Insolvency and Bankruptcy Code has altered the relationship between debtors and creditors for the better, but small and medium enterprises have gained nothing

)

premium

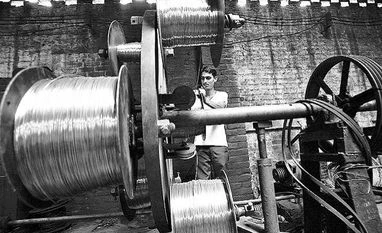

As suppliers of goods to defaulting companies, MSMEs are faced with losses during bankruptcy proceedings.

Last Updated : Aug 25 2018 | 7:31 PM IST

At 20 per cent, India has so far had the world’s lowest bad-loan recovery rate. As a result, in comparison to a year for London and 0.8 years for Singapore, the average time taken to resolve a soured account was 4.3 years for India. The lender recovery rate was, on average, 26.4 cents to the dollar, the poorest among emerging economies (World Bank).

However, in 2016, the Insolvency and Bankruptcy Code (IBC) was introduced in order to improve the prospects of loan recovery. The code makes a clear distinction between bankruptcy and insolvency while simultaneously enforcing a modern bankruptcy framework that empowers all classes of creditors in dealing with insolvency of individuals, corporates, partnerships and other entities. As a result, the relationship between debtors and creditors has undergone a positive change, leading to better availability of credit while improving the ease of doing business.

This paradigm shift has occurred as a result of consolidation of all existing insolvency-related laws. A strict time-bound manner to resolve insolvencies with a moratorium period of 180 days, extendable to 270 days, was put in place for companies under the waterfall mechanism. However, more than a year after its introduction, the code continues to be a work-in-progress.

Despite the changes in regulations and recent amendments, there still seem to be several grey areas in the IBC code, one of which is the waterfall mechanism that relates to the order of priority for distribution of assets during liquidation. Under this process, higher-tiered creditors receive principal payments and interest first, while lower-tiered creditors receive their dues only after full payment is made to those above them.

The order is: Insolvency resolution process and liquidation-related costs; financial creditors and workmen's dues for up to 24 months; other employee dues for up to 12 months; operational creditors; government dues (up to two years) and unsecured creditors; any remaining debts and dues; preference shareholders, if any; and equity.

The waterfall mechanism hasn’t been beneficial for operational creditors and certainly not for equity investors and promoters, who have minimum rights on the enterprise undergoing liquidation. Let’s take a look at how this affects MSMEs.

As suppliers of goods to defaulting companies, MSMEs are faced with losses during bankruptcy proceedings.

Fifth in order of priority for disbursement of funds, MSMEs are treated like operational creditors under the mechanism. In case of a collapse, they are allocated whatever is left after secured creditors, employees and resolutions are paid.

As suppliers of goods and services to defaulting companies, MSMEs face huge losses during bankruptcy proceedings. With their payments stuck for long periods, MSMEs bleed financially, leading to job losses and bankruptcy in certain cases. In fact, the National Company Law Tribunal has already admitted around 300 bankrupt MSMEs and started their resolution process.

The liquidation process usually triggers a chain reaction, creating a vicious cycle that affects MSMEs by putting them under severe stress.

MSMEs generally face a situation of delayed payments from their clients, typically large companies. In most cases, they end up taking loans, which they may not be able to repay if they don't get anything during liquidation.

The IBC review panel submitted a 90-page report to Finance Minister Arun Jaitley, which suggested that operational creditors of important MSMEs should get paid more than the liquidation value, due to their indispensability. The government must therefore turn its focus on improving credit growth for the MSME sector and give small operational creditors a higher priority in bankruptcy proceedings.

It is important to note that financial creditors undertake due diligence and evaluations before lending credit and only do so if they’re convinced of the company’s stability. However, operational creditors play a fundamental role in the daily business operations of a company, because they supply the goods and services, and are indispensable in that sense. For this reason alone, they must be treated on par with the financial creditors, if not higher.

The NCLT, while handling corporate civil disputes, gives elevated status to financial creditors as opposed to operational creditors. Financial creditors can start insolvency proceedings even for disputed debts but operational creditors cannot. Operational creditors, whose rights are limited and nominal, are not permitted to be part of the Committee of Creditors which determines the resolution plan of the matter. Should the adjudicating authority pass an order for liquidation of the corporate debtor, the financial creditors have priority over the operational creditors, which hurts the latter’s business.

Following the Reserve Bank of India’s directive last year, 12 large corporate loan accounts were referred by lenders to the NCLT. These companies together account for Rs 1.75 trillion in bad loans. It is estimated that in the process of settlement for each of these cases, at least 500-1000 MSMEs will go bankrupt owing to their status as operational creditors to these companies.

However, if MSMEs are brought on par with debt paid to financial creditors, their risks can be drastically reduced. Since MSMEs form the backbone of the country’s manufacturing sector and hold tremendous potential to create jobs, the case for moving them up in the priority list needs to be taken up at the earliest, so that their operations aren’t halted due to financial duress. At the same time, rigid conditions should be set so that the larger suppliers don’t take advantage of the situation, thereby hurting the interests of MSMEs.

Under the IBC, promoters of MSMEs primarily faced two major roadblocks. The first was the lack of opportunity to bid for their own firms during the liquidation process. With bidders showing little interest given their small scale, this meant that MSMEs had no option but to go in for liquidation. The recent Ordinance that allowed MSME promoters to bid for their own companies removed this impediment. Wilful defaulters are prohibited from bidding for their own companies, but there is an urgent need to extend the scope of the term “wilful defaulter” to family or friends, to avert any subterfuge.

The second and perhaps bigger challenge remains, since MSMEs continue to be placed way below on the priority list when it comes to distribution of proceeds during liquidation of bankrupt firms. This too should be addressed, to further strengthen the MSME ecosystem in the country.

The writer is founder and CEO, Power2SME

The writer is founder and CEO, Power2SME

Disclaimer: These are personal views of the writer. They do not necessarily reflect the opinion of www.business-standard.com or the Business Standard newspaper