SAIL revival hinges on cost tightening

While operating performance could improve, it may not be enough to help SAIL turn profitable

)

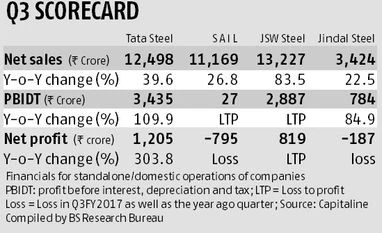

Steel manufacturers have seen a sharp reversal in fortunes after the government implemented a minimum import price (MIP) for many products last February. This gave a respite from cheaper imports, boosting realisations and demand for companies.

Steel Authority of India (SAIL), too, benefited and showed considerable improv-ement in profitability till the September quarter but could not sustain it in the December quarter. More dependent on domestic sales, it was impacted by the note ban as its volumes were hurt, while rising coal costs also took a toll. While analysts expect its operating performance to improve, they doubt whether it will be enough to enable the government-owned company to turn profitable.

Volume sales at 3.3 million tonnes were up 13.8 per cent year-on-year but 8.3 per cent lower than the 3.6 mt the previous quarter. Tata Steel saw volumes growing in the domestic business due to expansion at its Kalinganagar plant. JSW Steel compensated for decline in the India business with exports, and restricted the overall sales volume decline to five per sequentially. Even Jindal Steel & Power, much smaller than SAIL, saw volumes rise 3.7 per cent sequentially, helped by exports; its profit got a boost from its focus on value-added products.

For SAIL, the decline in volumes was accompanied by increasing realisation, also true for peers. At Rs 34,237 a tonne, it increased nine per cent sequentially and 11 per cent year-on-year for SAIL. But, rising costs more than offset the pricing gains. Coal costs alone were up Rs 5,000 a tonne sequentially, leading to an Ebitda (earnings before interest, taxes, depreciation and amortisation) loss of Rs 43 crore, from a profit in the previous two quarters, despite net sales growing 26.4 per cent from a year before in the December quarter. Sales were up marginally on a sequential basis.