Since the 1950s it has usually been a cocktail of partisan domestic interests that has resulted in the Reserve Bank of India (RBI) and the Indian government favouring an overvalued rupee. More recently, the US, European, Japanese and UK central banks kept interest rates too low for too long with real interest rates turning negative for prolonged periods since 2008. This has been reversed with the several sharp upward hikes of benchmark interest rate by several central banks in calendar year 2022, and by the RBI to contain high consumer price inflation. This article reflects on the attendant implications for the level of foreign exchange (FX) reserves that the RBI should hold.

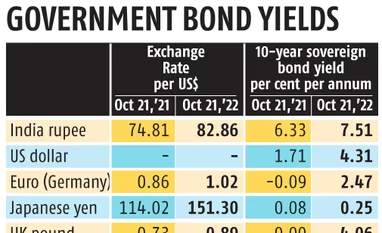

The table (see Exchange rates and government bond yields) shows the US dollar’s appreciation against other major currencies and INR. It also lists by how much 10-year sovereign interest rates have risen in the 12 months since October 2021.

Once interest rates were raised sharply by the US Federal Reserve, the European Central Bank, and the Bank of England, it was inevitable that the stock of foreign investment would come down as the risk-return trade-off turned against investments in India, putting pressure on the rupee.

The RBI is obliged to try and prevent any sharp appreciation/depreciation of the rupee to provide a stable environment for domestic and foreign investment in the real economy and financial securities. This includes being prepared for economy-wide shocks such as the Covid-19 epidemic and unusual interest rate and fiscal decisions of central banks and governments of large economies. This in turn means that India should have a large enough stock of FX reserves, which keeps pace with the size of the domestic economy, trade in goods and services, external hard currency debt and stocks of direct and portfolio foreign investments. Currently, India’s FX reserves are at about $530 billion, down from $640 billion about a year ago. However, the suggestion that about 67 per cent of the $110 billion decrease in India’s FX reserves was due to the downward revaluation in dollar terms of FX reserves held in euro, pound sterling and yen denominated government debt securities seems to be overstated.

Given higher nominal interest rates in INR debt instruments compared to the lower interest rates in G7 currencies, total factor productivity in India had to be much higher than in the US or western Europe if the INR were not to depreciate as would be projected by the simple interest rate parity theorem. As we know, speculators in international currency markets make outright exchange rate bets based on interest rate differentials between the INR and currencies of developed countries or take covered parity positions.

The US government looks askance at countries which have sustained current account surpluses of 2 per cent and above of gross domestic product (GDP). It follows that the US government is strenuously against what it considers excessive accumulation of foreign exchange reserves in dollars by central banks. Well, the US is shutting the stable doors long after the Chinese current account surplus dragon has bolted. An April 2021 US Treasury semi-annual report includes India in a list of potential currency manipulators.

Illustration: Ajay Mohanty

The overvaluation of the INR has been driven by the interests of Indian importers plus those who remit FX abroad and occasionally foreign institutional investors (FIIs). The INR tends to become overvalued due to higher domestic nominal interest rates and this was reason enough to let the rupee slide by gradual accumulation of dollar whenever there were opportunities without roiling the waters in domestic foreign exchange markets or with the US Treasury. Specifically, the gradual downward movement of the INR exchange rate against the dollar should have been about 10 paise a month after the taper tantrum in September 2013. On a related note, given that the dollar is likely to be the dominant reserve currency for at least another 10 years, the dollar should be given a dominant weighting in estimating the six-currency real effective exchange rate (REER) of the rupee against the dollar, euro, pound sterling, yen, and China’s renminbi.

As of now, the Moody’s rating for India is Baa3, which is just about investment grade and foreign institutional investors are rule-bound to give weighting to country ratings. In this context, the current account deficit projection for 2022-23 is around 3.5 per cent of GDP and Indian consumer price inflation was at 7.4 per cent in September 2022. Higher Indian GDP growth would alleviate concerns of foreign investors but growth estimates for 2022-23 are around 6.5 per cent and this number is projected by Nomura to come down to 5.2 per cent in 2023-24. Brent crude oil price per barrel was at $93 on October 25 and may be sticky around this level till uncertainties related to the conflict in Ukraine persist. India’s short-term debt, with residual maturity of less than one year, was $267.7 billion at the end of March 2022. All things considered, including the current and projected volumes of all foreign currency inflows/outflows and the perennial deficit in goods trade, it would be prudent for India to raise its FX reserves to at least $700 billion by December 2024.

j.bhagwati@gmail.com. The writer is a former Indian Ambassador, World Bank Treasury expert and currently Distinguished Fellow at the Centre for Social and Economic Progress

)