Put new money in shorter-duration bond funds

Limit allocation to longer-duration ones to 20-25% of the portfolio

)

premium

Last Updated : May 01 2017 | 1:20 PM IST

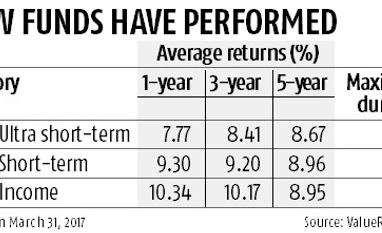

Debt mutual funds (MFs) had a good run until the Reserve Bank of India’s (RBI) monetary policy review in February, when interest rates were left unchanged and the policy stance changed from accommodative to neutral. The minutes of the Monetary Policy Committee’s meeting, released last week, indicated there were concerns about inflation.

This means there is likelihood of a rate hike if inflation rises beyond the RBI’s comfort levels. While pressure for inflation from domestic factors, such as high growth or wages, seems unlikely at present, there could be pressure from global factors, such as commodity price movement. In such a situation, which type of debt funds should one look at?

According to Amit Tripathi, head of fixed income, Reliance Mutual Fund, the interest-rate scenario is likely to remain unchanged in the near future. “The RBI will keep a watch on inflation and growth trends for the next five to six months before taking a directional view on rates. Whether it goes back to being accommodative or starts raising rates is something that will depend on inflation and growth trends over the next five to six months. Right now, it is status quo,” he says.

Safety in shorter-term debt funds: In such an environment, when neither a rate cut nor a hike is likely, the market will be driven purely by liquidity considerations. Investors are better off remaining in the short to medium part of the yield curve. “In the case of corporate bond funds, this means a duration of two to five years. In the case of government securities, one to 10 years. One should look at short-term bond funds or accrual funds. These will be more beneficial from an immediate risk-return perspective,” explains Tripathi.

Those wanting to make fresh investments should ideally look for funds where the average duration is three to three-and-a-half years. “But, if you are invested in a longer duration fund, there is no urgent need to switch right now, unless you are extremely conservative,” says Kaustubh Belapurkar, director–fund research, Morningstar Investment Adviser India. “We don’t expect interest rates to shoot up right away. But, if you are a very conservative investor and don’t want any volatility, maybe you could exit if your fund is running a high duration because there can be interim volatility. We have seen the 10-year benchmark move sharply. That kind of volatility will remain,” he says.

If you have invested in a dynamic bond fund, the fund manager has probably reduced the duration already. “Most managers in such funds have reduced the average duration to less than five years,” adds Belapurkar.

Investors must keep in mind that dynamic bond funds could also have higher volatility and muted returns, saysRoopali Prabhu, head of investment products, Sanctum Wealth Management. “If the fund manager has a proven long-term track record, patience may pay off. Investors tend to get complacent during bull cycles, and the past few months have served as a reminder of the risks,” she says. While there will be pockets of opportunity for fund managers overall, investors would need to expect a lot more muted returns, she adds.

Tripathi advises an allocation of 75 per cent to funds that have a duration of two to five years and 20-25 per cent to longer-term funds. In the latter category, your investment horizon should be three years or more. This allocation might need to be revisited whenever there is a change in interest rate outlook.

Go for accrual funds: In the current scenario, investors need to make a sharp distinction between accrual and duration funds. “We think accrual should serve investors well but, again, it’s not a time when an investor can just look at net yield-to-maturity and invest. Understanding the fund’s credit strategy is crucial,” Prabhu says.

Some of the high-yielding accrual and corporate credit funds come with greater risk, as evident from the recent instances of defaults, points out Belapurkar. “Invest in such funds only if you have the risk appetite for them,” he says.

Dispersion in corporate performance is likely to be relatively greater than in the recent past. Considering that, rating upgrades will provide opportunities. But, advisors will have to sharpen their due-diligence and research, and choose managers that can deliver, says Prabhu. Tripathi agrees for credit opportunity funds to perform, along with good performance by the sector and improvement in profit margins, the balance sheet also has to improve. So, fund selection in this category should be based on detailed analysis of the underlying portfolio of funds.