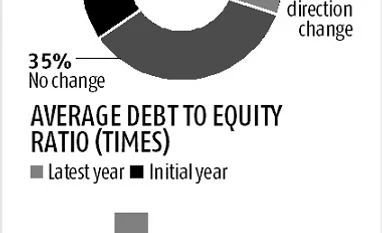

An equal number saw no change in rating, while 14 per cent were downgraded. The rest experienced multi-directional rating changes over these four years. For these MSEs who sought re-rating, their lender attractiveness was enhanced and consequently, their debt increased by 70 per cent. Those with stable ratings or upgrades witnessed improvement in their leverage profile (debt to equity ratio).

Says Manish Jaiswal, Business Head, SME Ratings, CRISIL: “SME Ratings introduce prudent risk management among MSEs and also create a credit profile trail, which is a great proof of performance when applying for loans. For lenders, such a rating history is an extremely valuable input for credit risk assessment and to reduce non-performing assets (NPA).”

To encourage credit culture among MSEs, the central government subsidises the initial rating through the National Small Scale Industries Corporation Ltd (NSIC). If this support were to also cover annual reviews for three to five years, it will help improve the credit ecosystem of the MSE sector, where lenders can extend loans based on credit risk history. Showcasing such performance also enables fund-raising.

Currently, less than one per cent of MSEs in India are rated. Says Jaiswal, “The credit profiles of MSEs with secured lending compare well with — or are perhaps even better than — mid-corporates and retail. Given this, the hour is right for the RBI to consider risk-weighted assets for capital allocation on the basis of the performance and credit rating scheme of NSIC for MSEs. And providing a booster such as enhanced rating subsidy to MSEs with turnover below Rs 2 crore could hasten revival of the sector, and eventually acceleration of the economy, in 2017.”

)